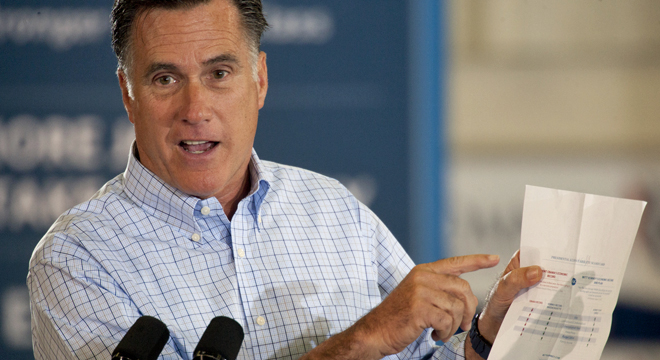

Mitt Romney is decrying as “garbage” an unfavorable analysis of his tax plan by citing a deficit hawk who has endorsed the study’s conclusion: he agrees that the Republican nominee’s plan would “raise taxes on the middle class.”

In an interview with Fortune magazine published Wednesday, Romney attacked the nonpartisan Tax Policy Center’s finding that fulfilling his budget promises would require asking 95 percent of Americans to pay more in taxes. “They made garbage assumptions and they reached a garbage conclusion,” he said.

“Simpson-Bowles laid out a formula that shows that you can do just as I described,” Romney continued, referring to the 2010 bipartisan fiscal commission. “That you can bring down the rates, limit deductions and exemptions for people at the high end, and with additional growth that comes by virtue of the stimulative action you can reach a balanced budget.”

But the commission’s co-chair, Erskine Bowles, has repeatedly said it’s not mathematically possible to meet Romney’s goals without asking the middle class to pay more in taxes.

“The Romney plan, by sticking to revenue-neutrality and leaving in place tax breaks, would raise taxes on the middle class and do nothing to shrink the deficit,” Bowles wrote in a Washington Post op-ed last week.

Romney has vowed to cut taxes by 20 percent across the board, a $5 trillion reduction from current law, and recover the lost revenue by closing loopholes in the tax code. He has repeatedly declined to identify a single deduction or credit he would eliminate to achieve this.

In the Post op-ed, Bowles, a Democrat who voted for President Obama in 2008, praised Romney for “pledging to reform the tax code to reduce loopholes” but warned that “his current proposal will not take us to the promised land.”

The federal tax code includes over $1 trillion in annual expenditures. A large chunk of them benefit the middle class, such as the mortgage interest deduction to encourage home ownership and the tax exclusion on employer-provided health care.

“I will follow a model similar to Simpson-Bowles and work with Congress to identify which of the alternative methods we should apply to reduce deductions, benefits, and exemptions,” Romney told Fortune. “Those reductions will occur for people at the high end. I have noted before my commitment to preserve tax preferences for middle-income taxpayers such as home ownership, charitable giving and health care.”

To date, neither Romney nor his supporters have been able to detail the math, apart from insisting that it’ll lead to new tax revenues via economic growth. Further complicating matters is his promise to maintain tax preferences on capital gains and dividends, which tend to benefit the rich. Last year, Bowles said Romney is “wrong” to suggest his plan is doable.

“To do what [Romney] says — to get rates as low as he’d like to get it, to get rid of the taxes on dividends and interest and capital gains and to get rid of the estate tax and to lower the top rate to 28 percent and also keep it progressive — you’re going to have to get rid of most, if not all, of the spending in the tax code, which would include things like the mortgage interest deduction,” Bowles told Bloomberg last year. “One area that Governor Romney is wrong is you can’t just affect the top 15 percent. It’s going to affect people throughout because it’s just not enough money there in getting rid of the tax expenditures that only affect the upper income people. You’re going to have to affect people down through the brackets.”

Alan Simpson, the fiscal commission’s other co-chair, wasn’t immediately available for comment, but his aide referred TPM to Bowles’ op-ed in response to an inquiry.

The fuzzy math threatens to derail a central plank of Romney’s pitch to voters: that he’s serious about tackling the nation’s greatest fiscal challenges. Obama has cited the Tax Policy Center study on the campaign trail, arguing that Romney wants to cut taxes on the rich and raise them on working- and middle-class families.