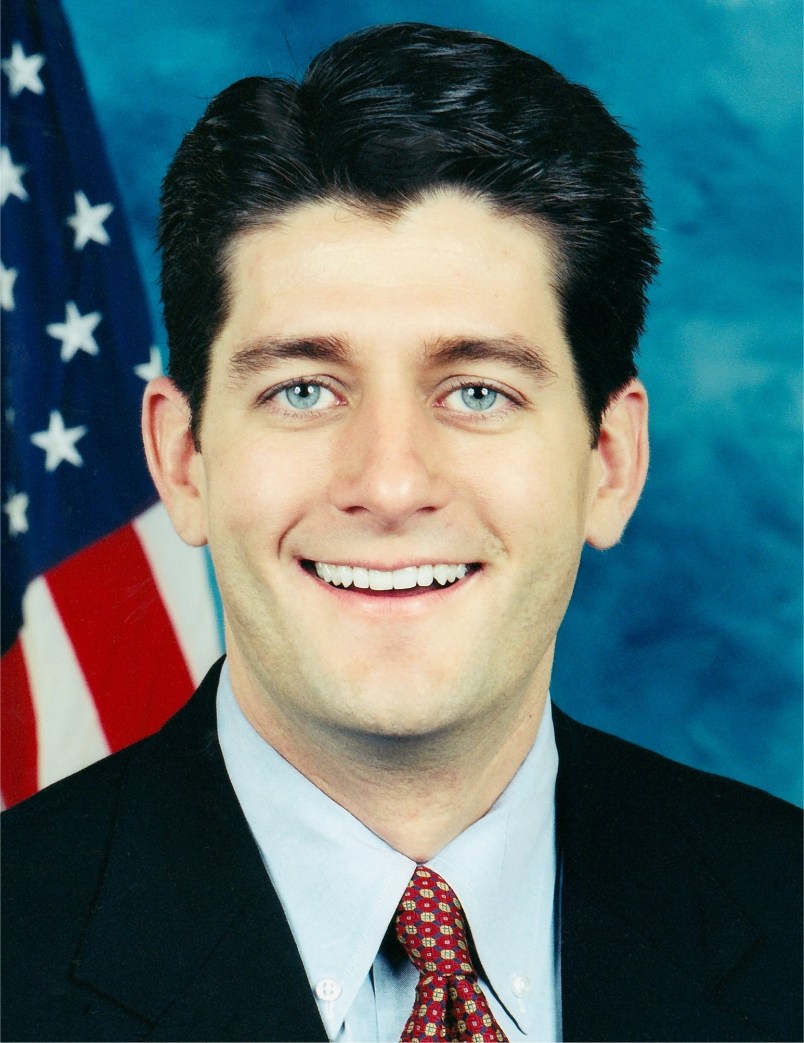

House GOP’s top budget guy Paul Ryan (R-WI) claims that his tax-cutting, Medicare and Social Security slashing fiscal roadmap would restore the federal budget to balance over a number of decades…and the non-partisan Congressional Budget Office has his back. But on close inspection, it turns out that CBO took much of its analytical lead from Ryan himself, dramatically skewing the numbers.

For their analysis Ryan provided CBO with a remarkable assumption: he asked CBO actuaries to assume that the major tax cuts he calls for won’t create any change in federal revenue over the next two decades–at all.

Here’s how they put it, in budget-ese: “As specified by your staff, for this analysis total federal tax revenues are assumed to equal those under [current fiscal policy],” the analysis reads.

There are just a couple major problems with that. According to Jim Horney, a tax expert at the Center on Budget and Policy Priorities, it doesn’t account for the tremendous loss in revenues the government would experience if, as Ryan’s plan calls for, the Bush tax cuts were extended and the Alternative Minimum Tax and estate tax were repealed.

“I haven’t seen them explain why they think the tax proposals he includes in the Roadmap would result in [the revenues they project] when it looks like it would be considerably less than that,” Horney told me today.

In 2008, the Tax Policy Center analyzed a similar GOP plan and determined it amounted to the biggest tax cut in history.

Whether Ryan was knowingly engaging in sleight-of-hand, or whether he was using an inaccurate supply side model to correlate tax cuts with increased revenue is unclear. But what is clear is that if CBO had based its analysis on an official accounting of the ways in which his proposed policy changes would impact revenue, they would have come to a different conclusion.

Horney says, “If you have revenue lower than assumed you would have a much much bigger buildup of deficits over the next couple of decades than they’re assuming, and what you don’t know is if the savings you get from cutting entitlements would bring you to balance later than expected,” or if they’d get you there at all.

So it’s a bit of bamboozlement. For his part, Horney doesn’t place the onus for this entirely on Ryan. He says that CBO ought not be granting the Ryan plan its considerable imprimatur if it’s not based on a complete analysis of the proposal.

“People see the CBO letter and most people assume that CBO had estimated the effect of these policy changes,” Horney told me. “It’s not a good idea for CBO to put out a letter that gives an overall estimate of the effects of a plan when…CBO has not estimated those policies.”