by Justin Elliott, ProPublica

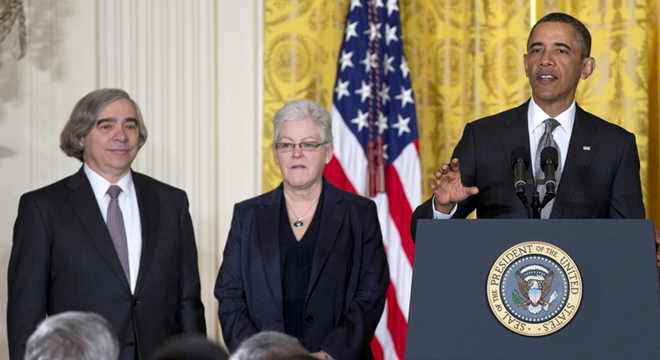

When President Obama nominated Ernest Moniz to be energy secretary earlier this month, he hailed the nuclear physicist as a “brilliant scientist” who, among his many talents, had effectively brought together “prominent thinkers and energy companies” in the continuing effort to figure out a safe and economically sound energy future for the country.

Indeed, Moniz’s collaborative work – best captured in the industry-backed research program he oversaw at The Massachusetts Institute of Technology – is well known. So, too, is his support for Obama’s “all of the above” energy strategy – one that embraces, fossil fuels, nuclear, and renewable energy sources.

But beyond his job in academia, Moniz has also spent the last decade serving on a range of boards and advisory councils for energy industry heavyweights, including some that do business with the Department of Energy. That includes a six-year paid stint on BP’s Technology Advisory Council as well as similar positions at a uranium enrichment company and a pair of energy investment firms.

Such industry ties aren’t uncommon for cabinet nominees, and Obama specifically praised Moniz for understanding both environmental and economic issues.

Still, Moniz’s work for energy companies since he served in President Clinton’s Energy Department has irked some environmentalists.

“His connections to the fossil fuel and nuclear power industries threaten to undermine the focus we need to see on renewables and energy efficiency,” said Tyson Slocum, director of the energy program at the consumer advocacy group Public Citizen.

Slocum pointed out that Moniz, if confirmed, will set research and investment priorities, including at the department’s network of national laboratories.

The Energy Department hands out billions of dollars in contracts and loan guarantees as it pushes energy research and development and administers the nation’s nuclear weapons stockpile and cleanup efforts. (On fracking, probably the highest-profile energy issue of the moment, the Environmental Protection Agency has jurisdiction.)

Reaction to Moniz’s nomination has been mixed among environmental groups, ranging from support (Natural Resources Defense Council) to concerned acceptance (Sierra Club) to outright opposition (Food and Water Watch).

What criticism there has been has focused on his support for nuclear power and for natural gas extracted through fracking as a “bridge fuel” to transition away from coal.

Here’s what we know about Moniz’s recent involvement with the energy industry:

- He was on BP’s Technology Advisory Council between 2005 and 2011, a position for which he received a stipend, according to BP. Spokesman Matt Hartwig said the company does not disclose details of such payments. (A 2012 BP financial report disclosed that one council member received about $6,200.) The council “provides feedback and advice to BP’s executive management as to the company’s approach to research and technology,” according to the company. BP has also provided $50 million in funding to Moniz’s MIT Energy Initiative. Moniz talked about that relationship while delivering a warm introduction before a 2009 speech at MIT by BP’s then-CEO Tony Hayward.

- From 2002 to 2004, Moniz sat on the strategic advisory council of USEC, a public company that provides enriched uranium to nuclear power plants. A company spokesman said Moniz was paid for his role on the nine-member council, but declined to say how much. USEC, which has been seeking a $2 billion loan guarantee from the Energy Department for a centrifuge plant in Ohio, has applauded Moniz’s nomination.

- He’s on the board of ICF International, a Fairfax, Virginia-based company which does energy and environmental consulting. It has received Energy Department contracts as part of what one executive called a “longstanding relationship with the Department of Energy.” As a board member, Moniz got $158,000 in cash and stock in 2011, according to the company’s most recent annual report.

- He is on the strategic advisory council of NGP Energy Technology Partners, a private equity firm that invests in both alternative energy and fossil fuel companies. The Washington, D.C.-based firm declined to comment.

- He is on the board of advisers of another private equity firm, the Angeleno Group,which says it provides “growth capital for next generation clean energy and natural resources companies.” The Los Angeles-based firm didn’t respond to requests for comment.

- He is a trustee of the King Abdullah Petroleum Studies and Research Center (KAPSARC), a Saudi Aramco-backed nonprofit organization. The organization did not respond to requests for comment.

- He was on the board of directors of the Electric Power Research Institute from 2007 to 2011, following a stint on the group’s advisory council that began in 2002. A nonprofit utility consortium, the organization does research for the industry with an annual budget of over $300 million. The group paid Moniz $8,000 between 2009 and 2011, according to its most recent tax returns.

- Since 2006, Moniz has been on the board of General Electric’s “ecomagination” advisory board which advises the company on “critical environmental and business issues.” The company did not respond to inquiries about compensation.

A spokesperson for the MIT Energy Initiative said Moniz is not giving interviews, and the White House didn’t respond to requests for comment.

Moniz’s nomination has not encountered resistance from the Senate, where the Energy and Natural Resources Committee is scheduled to hold a hearing on Moniz April 9.

As part of the nomination process, Moniz has to fill out a financial disclosure that will become public, along with an ethics agreement on how he will avoid any conflicts of interest.

If confirmed Moniz won’t be the first energy secretary who has been close to industry.

Steven Chu, the outgoing energy secretary, received scrutiny over his ties to BP. The company had chosen the lab Chu headed at the University of California, Berkeley, to lead a $500 million energy research project. BP’s chief scientist at the time of the grant, Steven Koonin, became Chu’s undersecretary for science.

When the Energy Department became involved in the government’s response to the 2010 Gulf oil spill, Koonin recused himself. Critics who thought the administration was too soft on the company pointed to Chu’s ties to BP. But no evidence emerged that Chu had played any role going to bat for BP within the administration.