The White House isn’t moved by Apple’s argument on Monday that U.S. corporate taxes are too high for the company to consider moving any of the staggering $64 billion in cash it has in offshore accounts back into the U.S.

A White House official told TPM that the Obama Administration specifically chose not to propose a repatriation holiday — a temporary tax break on overseas cash brought back into the U.S., which Apple and other tech companies have sought for years.

Instead, the official told TPM that the White House in late February put forth “a comprehensive corporate tax reform plan that simplifies the code, levels the playing field for American businesses and encourages investment here at home.”

In a paradigm shift, Apple on Monday announced that it would be spending a $45 billion domestic chunk of its nearly $100 billion in total cash reserves — the largest such stockpile in the United States — on paying investors dividends and buying back shares.

But the company also candidly stated it would refrain from repatriating any of its reported $64 billion in overseas cash into the United States any time soon due to what Apple chief financial officer Peter Oppenheimer deemed “significant disincentives.”

“Repatriating the cash would result in significant tax penalties,” Oppenheimer told investors and the press in a conference call on Monday morning. “The tax laws currently allow for a significant disincentive. We’ve expressed our views to Congress and the White House.”

At least some of those views have been “expressed” in the form of extensive lobbying by Apple and a cadre of other multinational companies. Bloomberg in September 2011 reported that an army of upwards of 160 lobbyists, including former members of Congress, had been pushing Congress to establish a repatriation holiday similar to one that was passed in 2004.

However, in that 2004 experiment, pharmaceutical companies were the largest beneficiaries and although $312 billion was brought back into the U.S. by some 800 companies, most of the money was spent on dividends and stock repurchases, as Bloomberg and the New York Times both reported, referring to numerous studies. In fact, some of the companies that benefited the most from the 2004 tax holiday ended up laying off employees.

In total, Congress in 2011 introduced three different bills designed to lower the corporate tax rate to around 5 percent, The Foreign Earnings Reinvestment Act introduced by Sen. Kay Hagan (D-NC), chief among them.

But now that Apple has re-ignited the conversation about overseas earnings, Hagan hopes that Congress will reconsider and pass the tax holiday.

“Today’s announcement by Apple only highlights the need to pass commonsense legislation that would allow American companies to put $1 trillion of foreign earnings back to work in the US economy,” Sen. Hagan told TPM. Hagan continued:

“Our stagnant economy demands practical, creative and bipartisan solutions right now. That is why Senator John McCain and I introduced the Foreign Earnings Reinvestment Act. This bill would trigger the flow of an estimated $1 trillion back into the American economy by temporarily allowing companies to return profits earned overseas to the U.S. at a temporarily reduced tax rate.”

The president’s proposal, by contrast, would lower the current top tax rate for U.S. companies to 28 percent from the current 35 percent. It would also impose an unspecified “minimum tax rate” on companies moving profits offshore. Apple and numerous other high-earning companies routinely keep money earned overseas in offshore accounts specifically to avoid paying U.S. taxes.

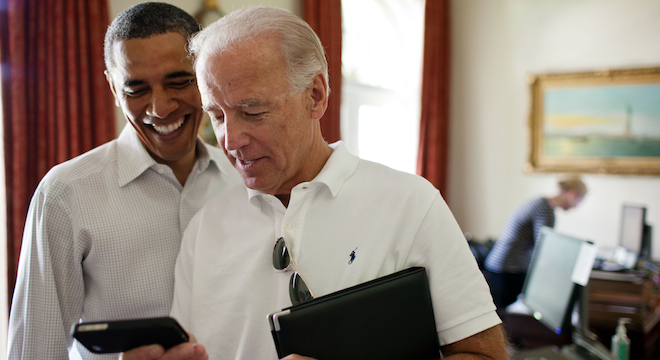

Before he passed away, late Apple CEO Steve Jobs reportedly voiced his concerns to President Obama that his Administration was creating a hostile climate for business. Jobs told his biographer Walter Isaacson that he even said to Obama face-to-face that Obama was “headed for a one-term presidency,” due to his hostility toward business.

As many writers and analysts have pointed out, Apple’s course of action on Monday was the safest one for Apple to take — rewarding investors while also avoiding the risk that could accompany an acquisition of another large firm.

Previous, semi-serious speculation had Apple perhaps announcing an acquisition of Twitter, a move that would make some sense given Apple and Twitter’s increasing collaboration (Twitter has been integrated into Apple devices as a default sharing option since Apple’s iOS 5.0 mobile operating system was released in October 2011). However, even in that case, it would seem that Apple would have still had to repatriate a significant sum, which the company refuses to do under current tax law.