The Obama administration on Tuesday proposed new guidelines to govern political spending by dark money groups, the tax-exempt entities that have grown and spread over the past few election cycles.

The proposed guidance issued by the Treasury Department and the Internal Revenue Service would define a new category of activity — “candidate-related political activity” — that would not qualify as social welfare.

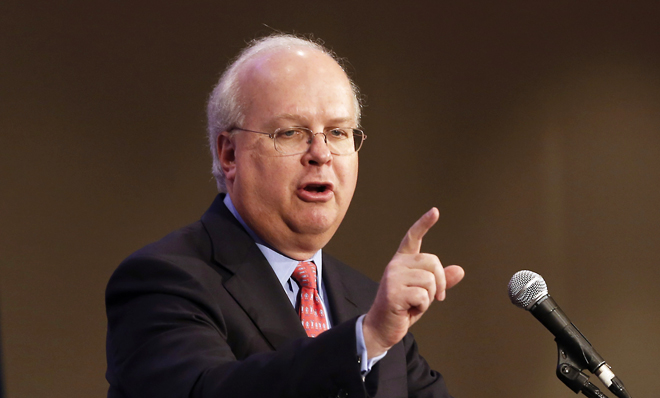

Dark money groups, which can raise unlimited amounts of money without disclosing their donors, are organized as tax-exempt “social welfare” organizations under section 501(c)4 of the Internal Revenue Code. A 501(c)4 group’s primary focus cannot be political activity, but that hasn’t stopped groups — like the Karl Rove-linked Crossroads GPS — from raising and spending tens of millions of dollars during election years.

“This proposed guidance is a first critical step toward creating clear-cut definitions of political activity by tax-exempt social welfare organizations,” Treasury Assistant Secretary for Tax Policy Mark Mazur said in a press release. “We are committed to getting this right before issuing final guidance that may affect a broad group of organizations. It will take time to work through the regulatory process and carefully consider all public feedback as we strive to ensure that the standards for tax-exemption are clear and can be applied consistently.”

The “time” referred to by Mazur may be months or more. The Treasury Department and the IRS both expect a large number of comments to come in about the new rules, and The Wall Street Journal reported Tuesday that the process could take more than a year, pushing it past next year’s midterm elections.

Regardless, the announcement was greeted as big news by campaign finance watchers.

“This is a long time coming,” Rick Hasen, a law professor at the University of California, Irvine, wrote on his blog on Tuesday. “Whether one likes 501(c)(4) involvement in campaigns or not, lack of clarity is a problem both for groups which can face harassment or the public which is ill served by the failure to enforce existing law as written.”

In its press release, the Treasury Department outlined the kinds of activities that would be considered “candidate-related political activity” under the proposed guidelines. Among them were communications that expressly advocate for a candidate or party, communications made within 60 days of a general elections that clearly identify a candidate or party, and grants to 527 political organizations and other tax-exempt groups that conduct candidate-related political activities. Additionally, voter registration drives and get-out-the vote drives would be considered candidate-related political activities, as would holding an event at which a candidate appears within 60 days of a general election.

The administration hopes these proposed changes will reduce the IRS’ need to conduct “facts and circumstances” tests to determine whether a group is engaged in political activity, by replacing that test with “more definitive rules.” (You may recall some controversy about the IRS’ screening of tax-exempt political groups.)

And that might not be all.

The administration also hinted that further changes could be coming: The Treasury Department and the IRS announced they are seeking comments on the percentage of a 501(c)4 group’s activity that must promote social welfare, and whether the proposed rules announced Tuesday should be applied to other kinds of tax-exempt groups.