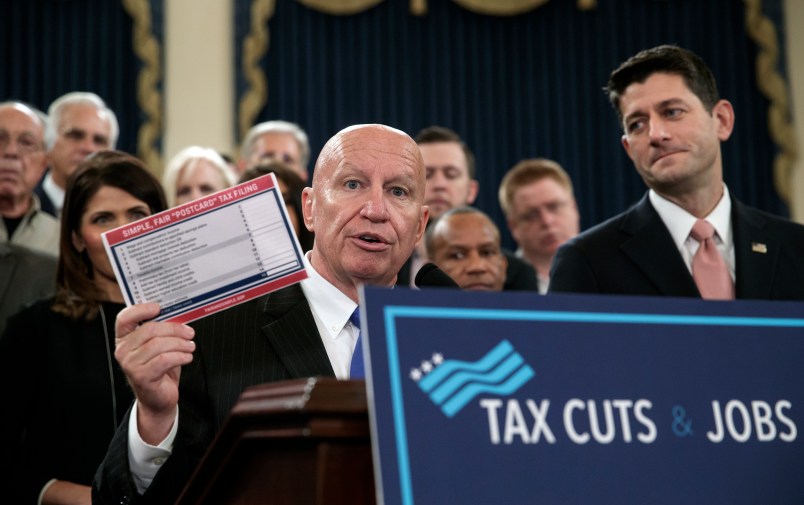

House Republicans unveiling their 429-page tax reform bill Thursday morning promised it would bring simplicity and prosperity to all.

“On net, everyone’s better off,” Rep. David Brat (R-VA) enthused to reporters in the hallway outside the room where lawmakers were briefed on the bill.

But like the current tax system, the House GOP plan would have winners and losers.

The draft released Thursday lowers the corporate tax rate from 35 to 20 percent, nearly doubles the standard deduction, and keeps a loophole for hedge fund managers that President Trump had promised to eliminate.

To partially make up the cost, the proposal gets rid of a host of deductions—including those for medical expenses, moving expenses, hiring veterans, investing in poor neighborhoods, alimony, employee achievement awards, adoptions, the interest paid on student loans, most electric cars, and state and local taxes—while putting new limits on several others, like the interest paid on home mortgages.

Rep. Dan Donovan (R-NY) urged his colleagues and the press not to sweat these details. “I’m looking at the plan overall,” he said. “If you pick out a part and only look at one thing, one thing could look great, but the elimination of other things might diminish the importance of that. Or something might look bad, but when you see the other benefits people get, it could be okay.”

Yet a firestorm of criticism began to ignite as soon as details of the plan began to leak out earlier this week, with major outside organizations on the left and right announcing their opposition to the bill. Here are the five most controversial provisions tucked into the text that could doom Republicans’ top legislative goal.

House And Home

The tax bill’s changes to the treatment of mortgage interest and property taxes have already incurred the wrath of the powerful housing sector, including the National Association of Home Builders and the National Association of Realtors, who warn the changes could lower home prices and depress the economy overall.

The bill would cap the deduction for property taxes at $10,000, lower the cap on mortgage interest deduction from $1 million to $500,000 on new mortgages, and completely eliminate the mortgage interest deduction for homes that are not a “primary residence.”

“For a lot of folks who were current homeowners, they won’t get as good a price when they sell, because they bought their homes with the deduction but the next buyer won’t be able to,” explained Stan Collender, a former top staffer on the House and Senate Budget Committees, who worked under both Republican and Democratic administrations. “This will have a negative effect up and down the spectrum, on the housing sector and all the industries around it.”

Taking Care

Though a last-minute demand from President Trump to include the repeal of Obamacare’s individual mandate in the tax bill went unheeded, several provisions in the bill do impact what families spend on health care.

The legislation gets rid of the itemized deduction for medical expenses—which people can currently use to write off major health care expenses for themselves, a spouse or a child.

“Because this deduction only kicks in for people who have exceeded 10 percent of their income, the people who benefit from are the very sick who have high health care costs,” explained Larry Levitt, vice president of the Kaiser Family Foundation. “It’s particularly important for those who chronically ill and getting long term care, including seniors and disabled people, or their families who are taking care of them.”

A different provision would get rid of deductions for the money people put into certain kinds of medical savings accounts, while another would eliminate a tax credit for companies that make drugs that treat extremely rare diseases.

The AARP came out swinging against these “health taxes” on Friday.

Campus Woes

Several controversial provisions in the tax bill concern education—particularly the elimination of the student loan interest deduction, which currently allows students and graduates to write off up to $2,500 a year. About 12 million people claim this deduction every year, according to the IRS.

Collender told TPM that while the amount most will lose in deductions is relatively small—just a few hundred per year—it means a great deal to those scrambling to start their careers.

“To students, a couple hundred bucks is a significant amount of money,” he said. “They’re looking for nickels and dimes off the pavement. They’re living paycheck to paycheck. I know young people don’t register and don’t turn out to vote in big numbers, but boy, this will get them coming out of the woodwork in 2018.”

Under the bill, the deduction for qualified tuition and related expenses would also be repealed, and private college endowments would be hit with a new 1.4 percent tax. The bill also gets rid of the American Opportunity Tax Credit and the Lifetime Learning Credit, which benefit students who take more than five years to graduate. It also would hurt both graduate students who work as teachers’ assistants and the college that employ them by making their tuition waivers no longer tax-exempt.

SALTing The Wound

One of the most sensitive provisions in the bill is the repeal of the deduction for state and local income taxes (SALT) and sales taxes—a deduction that currently lowers the federal taxes of people living in states that have high local taxes. Repealing this provision hammers blue states like California, New York and New Jersey, putting the GOP House members from those states in a difficult position.

At least four, New York Reps. Lee Zeldin and Peter King and New Jersey’s Frank LoBiondo and Leonard Lance, have already vowed to vote no if changes are not made. More are on the fence and withholding their endorsement for now.

“I’m concerned about the elimination of the SALT deduction,” Rep. Dan Donovan (R-NY) told reporters Thursday morning. “Yesterday Lee Zeldin and myself presented an alternative to the Ways and Means Committee and leadership with a version of SALT. We’re still in the process of fighting for it.”

Collender predicted to TPM that more than a dozen blue state House Republicans could lose their seats if they vote for it, because their constituents would see a major tax hike.

“I know the Republicans think if they don’t do a tax bill they’re putting their House majority in jeopardy,” he said. “But if they do do it, they’ll also put it in jeopardy.”

Knocking Down A Church-State Barrier

Buried in the final two pages of the 429-page legislation is a provision repealing the so-called “Johnson Amendment”—a 50-year-old policy that churches and other houses of worship can’t remain tax exempt if they endorse candidates or engage in partisan politicking from the pulpit.

The current law, which is almost never enforced by an IRS hesitant to meddle in religious affairs, has been a target of President Trump since the campaign trail. Government watchdog groups and secular advocacy groups say its repeal will lead to a dangerous mix of the sacred and the political.

“This new legislation seems like a recipe for disaster,” Common Cause President Karen Hobert Flynn said. “The legislative language would thrust the IRS into the sure-to-be-controversial task of determining whether the context and amount of expense qualifies for the new exemption.”

“The repeal of this rule would enable religious organizations to potentially operate like Super PACs,” warned the Secular Coalition for America.

Thank you Ms. Ollstein, for this helpful summary of the bill.

Bonus points to Ms,. Ollstein for asking Stan Collender about this stuff. Away back in the days of the Sequester his blog posts were more informative than anything else you could find in determining what was was actually going to happen. Since last I heard he was working for Forbes behind a hostile wingnut paywall, I’m pleased that he’s sharing his knowledge with the outside world.

He says that the high-tax-state GOPers are not going to be deceived about the toxic nature of the state tax grab, so that’s what’s happening. For a GOP congessman, survival outweighs everything*, including party loyalty.

*With the possible exception of direct personal Agnew-style bribery.

If these are really the 5 most controversial provision, this will sail through House and Senate.

First off, many churches, in support of both democrats and republicans, engage in endorsing candidates. Like the article stated the restriction is never enforced so might as well get rid of it. Second, the mortgage deduction elimination on a “non primary” residence makes sense. It is a provision generally that favors the wealthy who own multiple homes. Third, if your state taxes you too much, then take it with your state. Why should people in other states have to pay to underwrite your state’s high taxes? My State has no income tax and we do just fine.

I absolutely HATE tax reporting.

There must be some compromise between a narrative of hypothetical winners and losers, based on assumptions that match nobody, and reading the 400+ page bill myself.

Maybe I’m not Googling optimally, but in a dozen articles I still can’t find what are the new rates and at what income levels do they kick in? Doubling the standard deduction is going to be a far better deal than the itemized deductions being eliminated for most middle class people, but the devil is in the rates!

They kept mentioning business loopholes that allow a far lower tax rate then the maximum listed and how they need to get rid of those (or some of) loopholes. However it looks to me that the burden of decreased deductions and credits are only directed at the middle class/poor. They keep saying that giving money to businesses and the rich will supercharge the economy. The only empirical evidence shows exactly the opposite. It’s a total lie just as their frequent statement that the US is the highest taxed modern nation (totally false, we are at the bottom end). Tells you something that the only way they have to sale this to the people is by total lies. They even raise the bottom rate on the lowest earners! This is not a tax break for all but a gift to the rich on the backs of everyone else, typical Republican ideology. The removal of the “religious” exception is unethical in my opinion; it is “special” treatment by the government of religious activities. It falls in the area of Doctors, therapist, educators, etc. taking advantage of those who are under their influence and it is simply wrong. They should enforce the law, not pick and choose the ones they like. The IRS should be enforcing current law. There are other, better places for politics then one’s house of worship. If you disagree with your religious leaders that implies you are not just wrong but a “sinner” which is in no way appropriate. Sometimes that is even stated explicitly and not just implied. Patriarchy in action.