A leaked draft of legislation that represents the closest that congressional Republicans have come to signaling their way forward on repealing the Affordable Care Act is already up in flames, in part due to a revolt from the caucus’ hard right wing over a proposal that has been a mainstay of GOP health plans in recent years.

The objection by conservative members and outside groups to the draft proposal – and especially its inclusion of tax credits for Americans to use on individual insurance – shows how far GOP lawmakers still have to go in resolving the differences within their party over basic health policy questions.

“It’s a real problem for conservatives because it represents a new entitlement,” Rep. Mark Sanford (R-SC), who has introduced his own Obamacare replacement bill alongside Sen. Rand Paul’s (R-KY) in the Senate, told reporters Tuesday. “From a numerical standpoint, we can’t pay for the entitlements already on the table. So the idea of adding a new one would be more than problematic,” Sanford said.

The current squabble, which is just one of many surrounding the politics and policy particulars of repeal and replace, is centered on the refundable tax credits for Americans to use on insurance in the individual market. Individuals under 30 would receive a $2,000 annual tax credit, under the draft proposal, and that amount would increase with age. Unlike Obamacare’s tax subsidies, they don’t vary by income — a wealthy person would get the same tax break as a poor one — and they also don’t vary by geography, meaning in some places where premiums are lower the credit will go farther than others.

But among conservative hardliners the main objection is that the credits are refundable, meaning if you owe less in taxes than the government credits being offered, the government will still offer the rest of the subsidy. They have slammed the tax credits — particularly if they are doled out in this fashion — as a form of Obamacare-lite.

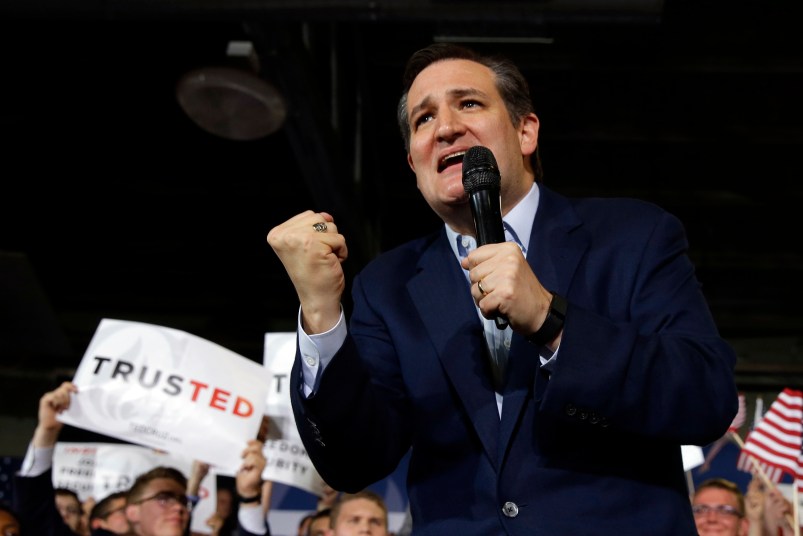

“I think the approach that makes sense is to focus where there is consensus,” said Sen. Ted Cruz (R-TX), pointing to proposals like selling insurance over state lines and expanding health savings accounts.

“Rolling out a massive new entitlement program is not the right approach to go,” he told reporters Tuesday.

The revolt, not surprisingly, started in the House, where House Freedom Caucus Chair Mark Meadows said Monday he would vote against the draft proposal if it was offered as the final bill. (The 40-or-so member caucus has not taken an official stance, but many members have echoed his frustrations).

He was joined by the chairman of the House Republican Study Committee, Rep. Mark Walker (R-NC), who said in statement Monday he too would vote against a proposal resembling the draft form and would urging the members of his group – which totals 172 members – to do the same. They got a boost from three senate conservatives – Cruz, Paul, and Mike Lee (R-UT) – who tweeted their support for the hardline stance later that evening. Outside Tea Party groups have also cheered on the conservatives’ resistance to the Republican proposal, while bashing the draft as “ObamaCare-lite” and Obamacare “Retain and Repair.”

The GOP lawmakers leading the effort to draft the repeal legislation played down the resistance to their plan.

“I think we’re heading in the right direction on this. We’re continuing to build support,” House Ways and Means Chair Kevin Brady (R-TX) told reporters Tuesday.

House Speaker Paul Ryan (R-WI) noted at his press conference Tuesday that many conservatives supported tax credits when they were part of the plans offered by House and Human Services Secretary Tom Price when he was a House member.

“The current tax code discriminates against people who don’t get health care at work,” Ryan said, referring to the tax exclusion for employer plans, which Republicans are also considering changing. “We want to end the discrimination in the tax code against people who don’t get health care through work and equalize the tax treatment of health care, so everybody, regardless of whether you get health care at work or don’t, has an opportunity to get a health care plan that’s affordable for you.”

GOP leaders stressed that the leaked text was merely a draft and a work in progress, and that they’re continuing to make changes, but what those changes will look like remains unclear.

Sen. Lamar Alexander (R-TN), who as chair of the HELP committee is a key figure in the process, said the credits “could very well” be in the final bill.

“A tax credit, which would help lower income Americans buy insurance, has been one of the provisions in almost every one of the Republican proposals that have been made over the last several years,” Alexander said, before adding that “we have a ways to go before we have a final bill. “

The disagreement highlights the stark differences among GOP lawmakers in their approach to dismantling and replacing the Affordable Care Act. For the more moderate Republicans, and especially the ones hailing from Medicaid expansion states, they can point to the tax credits as a way to cushion the blow of dismantling the ACA’s expansion of the program – which has extended coverage to at least 14 million people – and its other benefits.

“You know, I understand you’re not going to get everybody on board but hopefully we get enough people on board to make it work. And I think the refundable tax credit will be part of it,” Sen. John Hoeven (R-ND), whose state expanded Medicaid, said.

The infighting has occurred as President Donald Trump has, at least publicly, largely kept out of the details of the effort. Lawmakers on both sides of the tax credits issue said signaling from the White House could play a major — if not a deciding — role in the debate, and indeed Trump, ever so gently put his finger on the scale for the tax credits in Tuesday night’s address to a joint session of Congress.

He said that “we should help Americans purchase their own coverage, through the use of tax credits and expanded Health Savings Accounts,” while name-checking some of the other proposals floated by leadership. He did not go into any more detail.

Ryan after the speech suggested that these comments were an endorsement of the plan leadership has been working on. But the hardliners weren’t so sure.

“He didn’t say refundable tax credit in there. He said tax credit, which our bill has,” Sanford told TPM after the speech.

“As far as the tax credits are concerned, I don’t know if that settles that at all, completely,” Rep. Steve King (R-IA) told TPM.

Even before the leaked draft, the conservatives were beginning to raise their concerns about how the tax credits. Some speculated that by being refundable, the credits would be susceptible to abuse.

“Anytime the government is sending you a check, there’s an opportunity for fraud, there’s an opportunity for mismanagement of those funds, and it’s almost like a Big Brother mindset that we are paying you to make sure you have insurance,” Walker told reporters earlier this month, after a listening session the proposal. “I am just asking the honest question: Is a tax deduction better than the tax credit? That’s what we have to come to terms with.”

A briefing document leadership gave to the House GOP caucus earlier this month outlining the proposals on the table anticipated the debate over whether the credits should be refundable, or merely year-end deductions.

“When deciding between the two options, intent is critical: if the credit is to be valuable to the low income— those who are most in need of assistance to purchase health insurance— then refundability is an important feature,” the document said.

“We want to help everybody, even those who don’t pay taxes. That’s why a credit is preferable, in my judgement, to a deduction,” Rep. Leonard Lance (R-NJ), a member of the Energy and Commerce Committee as well as the moderate Tuesday Group, told reporters Monday.

Asked if it can pass the House, he said, “I am hopeful that it can.”

Corrected: This story has been corrected to reflect that Rep. Mark Sanford represents a district in South Carolina, not North Carolina.

They’re just arguing over which plan will assure lousier coverage for Americans. I am confident that whatever choice they make will be the worst possible option…and very possibly repeal with no replace. They are that stupid, that selfish and that vindictive.

Can we get a competency hearing for the GOP?

I have to say that the ultra-conservative side of the internal battle is the more coherent one here – that side just wants some tax cuts for those earning enough to pay taxes, and they don’t give a shit about healthcare coverage for those who can’t afford it.

The side supposedly trying to replace Obamacare instead of just eliminating it has created the most craptacular approach possible.

It eliminates the taxes that supported the ACA subsidies and Medicaid expansion. Then it provides a tax credit that goes even to people who don’t need it. Naturally, that creates a massive hole in the budget. To close that hole, the new plan will tax those who have been receiving employer subsidies of insurance as a tax-free benefit.

That tax would hit low-paid employees the most, because their insurance benefit is relatively large in comparison to pay. The burden on low-paid workers and the overall politics of a new tax limits how much revenue can be raised, so the tax credits will necessarily have to be kept low – too low to make health insurance affordable for millions of people who can afford subsidized ACA plans.

So, the replacement plan is already a mess just from the money perspective. On the insurance and healthcare side, the GOP has yanked out major supports in the carefully constructed ACA system that allowed insurance companies, hospitals, and healthcare providers to function in a world where coverage was expanded to millions who had pre-existing conditions or who could not previously afford insurance. Insurance companies will instantly raise rates and drop coverage for customers with high healthcare costs. Hospitals will start jacking up negotiated rates to cover the new surge of uninsured patients. Etc.

It’s an ineffective mess.

watch how easy they accept tax credits for the bill the puppets daughter is pushing.

giving income earners up to 500,000 a year tax credits for hiring child help…and the catch being you must first pay it out…meaning low income families will get nothing since they cant afford the payments up front.

" poor families will get nothing since they can’t afford to pay up front"

Yes the classic feature and not a bug!

The whole idea is to not do this and then claim that they tried. Or did not, depending on the audience!

“We can’t have this plan, it doesn’t fuck TEH POORZ hard enough!”

Signed,

The Freedumb Caucus