On Monday, the Tax Policy Center released a new analysis of the House tax bill that disproves claims from GOP leadership and the Trump administration that the deep tax cuts for corporations and the wealthy will create so much economic growth that the bill will pay for itself.

Treasury Secretary Steve Mnuchin recently insisted that “not only will this tax plan pay for itself, but it will pay down debt.” White House economic adviser Gary Cohn agreed, saying that “we can pay for the entire tax cut through growth over the cycle.”

Yet the new study by the Tax Policy Center finds that while the bill would somewhat boost the nation’s economic output, leading to more revenue for the government, it would not be enough to offset the revenue lost by the tax cuts. The net effect of the bill would be to increase the deficit by $1.27 trillion over 10 years.

The estimated growth would be lower than promised and the impact would diminish over time. The Tax Policy Center estimates that the tax cuts would increase the U.S. GDP by 0.6 percent in 2018, 0.3 percent in 2027, and 0.2 percent in 2037.

The revenue generated by the growth would be about $169 billion over 10 years—a drop in the bucket to the revenue the government would lose over that same period.

This study echoes the findings of other analyses—including one conducted by President Trump’s alma mater, the Wharton School of Business—showing that even when taking growth into account through so-called dynamic scoring, the tax bill would still balloon the deficit.

Read the full report below:

ohhhh another bomb thrown into the great escapade.

Gets better by the day.

Is that 3, 4, 5 bombs so far?

Waiting for the" big bang" around 2 hours before the senate vote.

When ryans sad, his ears wilt it seems. lol

there needs to be someone, IMO, that needs to be a good marketer of quipy slogans that make clear that tax breaks for billionaires is nothing more than a transfer of future earnings from the nations youth to today’s billionaires

A Republican billionaire tax break today = $1.5 trillion in debt for your child tomorrow, don’t let Republicans make your kids pay for a billionaire’s yatch

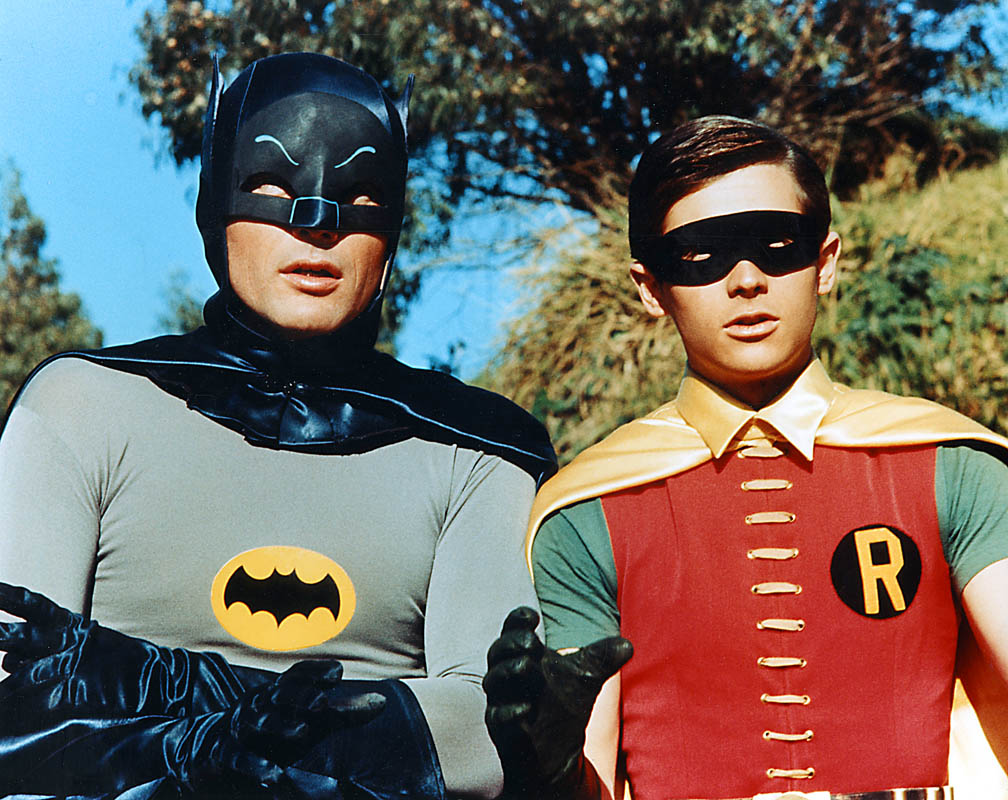

Ohhhhhh, you should have used Dynamic Duo scoring.

Anyone who professes shock at this finding, please raise your hands. I have a bridge in Brooklyn I’d like to sell you.

It’s pretty bad when you cheat and still lose, and “dynamic scoring” is just cheating. I wonder what the numbers are like if you evaluate the bill the way it is usually done…I haven’t seen a CBO evaluation yet, that should be done before any votes go forward. But, of course, the Republicans will continue cheating, that’s the only way they can force this monstrosity on America.