On Wednesday the House and Senate hold the first public conference committee meeting to iron out significant differences on the GOP tax bills — though Republican lawmakers and their staffs have already been negotiating behind closed doors for several days. Just before going into the conference, lawmakers announced they had tentatively struck a deal on changes to the bill that will further benefit the highest earning Americans, including a reduction in the top income tax bracket from 39.6 to 37 percent.

They reportedly plan pay for this change and others by ticking up the new corporate tax rate from 20 to 21 percent—which remains a major reduction from the current 35 percent rate.

While the full details of the revised tax plan have yet to be announced, the AP reports that changes include a $750,000 cap on mortgage interest deduction—a compromise between the Senate bill keeping the current $1 million cap and the House slashing that in half to $500,000. The revised bill also includes a 20 percent deduction of earnings for owners of pass-through business, including law firms, hedge funds and small businesses, and sets a $10,000 limit on deductions for state and local taxes (SALT), a measure predicted to hammer progressive, high-tax states like New York and California.

“It’s hard to believe they could make this new tax bill even worse than the last one,” Senate Minority Leader Chuck Schumer (D-NY) fumed on Wednesday. “Their illogic is amazing. The idea was that [cutting] SALT would hurt the middle class, but instead of undoing their repeal of state and local deductibility, they reduced rates further on the rich. That doesn’t solve their SALT problem.”

In their revisions, Republicans backed off of some of the more controversial provisions included in the House bill, including one that would have massively hiked the taxes of graduate students, but kept others, including provisions repealing Obamacare’s individual mandate and opening up the Arctic National Wildlife Refuge for oil drilling.

Democrats named to the conference committee, who have been excluded from the backroom negotiations, blasted the rumored revisions.

“They’re basically just rearranging the chairs at the country club,” Sen. Ron Wyden (D-OR) who sits on the conference committee, told TPM on Tuesday. “Maybe multinationals do better one day and well-to-do heirs do better the next day. But our message is still that the middle class is getting short shrift here.”

Despite calls from Democrats to delay the vote on the tax bill until newly-elected Sen. Doug Jones (D-AL) is sworn in, Republican leadership says they remain on track to push through a final version before Christmas, with a final vote likely next week.

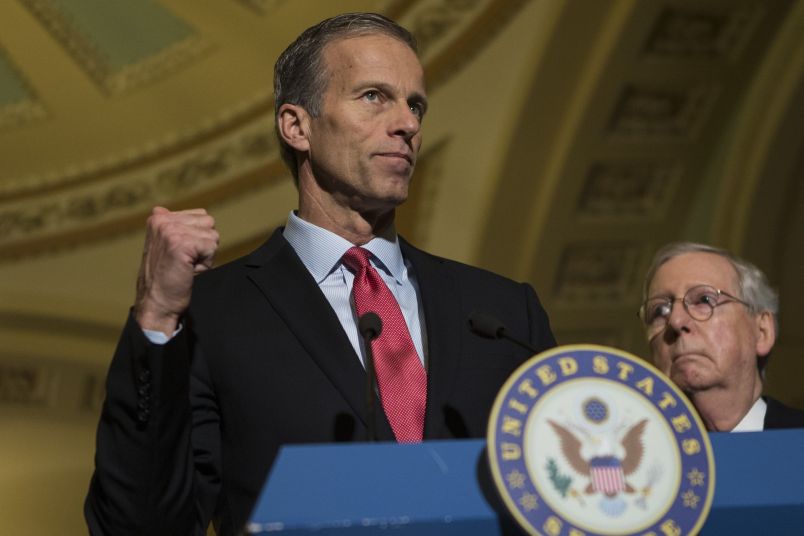

“We’re making good headway,” Sen. John Thune (R-SD) told reporters. “We’re starting to narrow the gap between the House and the Senate on all the major issues. We’re getting close.”

WTF?? Corruption reigns!!

I am reminded of the Roman Senate scene from “History of the World Part 1”

The Senate in Action

Yep, with Mr. Jones coming to Washington Uncle Yertle knows that the gig is now up. Gotta get this dung heap moved ASAP.

Let’s just hope that Corker, Flake or Collins flip their votes now and at least one of them, becasue we now need only one, votes against reductions in social programs in 2018.

Well, they certainly learned their lesson from the Moore debacle.

So billionaires get a negative tax rate?