It’s shaping up to be a clash of the titans.

On the one hand, Senate Democrats aren’t stepping back an inch from their pledge to move ahead with financial regulatory reform, with or without Republicans, by the end of next week. In fact, just today, President Obama threatened to veto a final bill if it’s weakened too much during the legislative process.

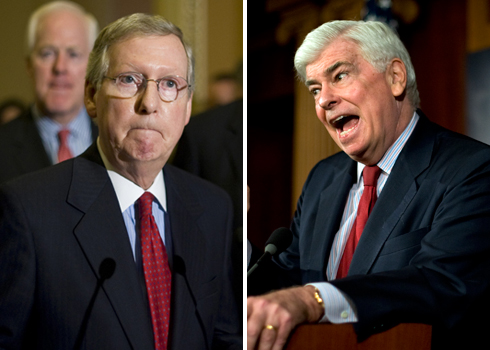

But on the other hand, Republicans have coalesced around a strategy of uniform opposition to the Democrats’ draft legislation authored by Senate Banking Committee Chairman Chris Dodd.

So we’re at an impasse.

Democrats don’t want to deviate far from the Dodd draft, and they love the politics of putting Republicans and Wall Street on the same side of a battle line. They hope the optics there will be so bad, that Republicans will ultimately be shamed into caving. But ultimately Dems need 60 votes simply to debate the bill, and if the Republicans stick together in the face of a likely political backlash, there won’t be a bill. And nobody knows dedication like the Senate GOP.

Assuming Dodd, and his counterpart Sen. Richard Shelby (R-AL) don’t reach some sort of agreement this week, this can only play out in a handful of ways:

–One or two Republicans could break off next week and allow the bill to come to the floor.

–If that doesn’t happen, Democrats could stick to their guns, until political pressure forces the GOP’s hand.

–The political food fight could continue, while in the background Democrats and Republicans reach a compromise of some kind.

–Despite the…highly questionable…nature of the claim, Republicans could win the spin war and convince the public that the Dems’ bill really will lead to “endless” taxpayer funded bailouts.

–Republicans can go down swinging, and no bill will pass.

Now, it’s important to note that Republicans are mainly taking issue with the sections of the bill that deal with “Too Big To Fail” institutions. And Obama linked his veto threat to a separate section of the bill that addresses derivative trading. And though Republicans also oppose Dem proposals for regulating derivative swaps, it’s conceivable that an agreement will be reached whereby Republicans give Dems ground on derivatives, while Democrats inch toward the GOP position on resolution authority, etc. Today, Senate Agriculture Committee Chair Blanche Lincoln unveiled far-reaching legislation to regulate the derivatives market.

It’s also important to note, as I did in this post, that while the GOP’s tone is pretty extreme, they haven’t vowed to use Senate filibuster rules from preventing the bill from coming up for debate. So there is some wiggle room.

But with rhetoric this heated, it’s hard to imagine the two factions joining hands to sing kumbaya before this comes to a head.