The Obama administration’s announcement Thursday night that it would exempt people whose policies have been canceled because of Obamacare from the law’s individual mandate was an unexpected move.

The White House had been under fire for months over the widespread reports of canceled policies, but rather than assuage those concerns with the new exemption, it runs the risk of opening one of the law’s most important (and most unpopular) features to more political meddling.

Congressional Republicans have already used it as an excuse to call for a blanket delay of the individual mandate, and some of the law’s most ardent supporters acknowledge that the administration seems to have cracked open a door that could be difficult to close.

“I think by itself this is a not a huge problem. This group should be relatively small,” Jonathan Gruber, an MIT economist who helped craft Obamacare, told TPM. “But I think that the administration has to hold the line here. More widespread cracks in the mandate could start to cause enormous problems for insurers.”

Obamacare already included a “hardship exemption” from the individual mandate, allowing people who couldn’t purchase insurance at an affordable price to avoid paying the penalty ($95 or 1 percent of your income in the first year, whichever is greater). The administration’s announcement Thursday means Americans whose policies have been canceled would fall under that hardship exemption and be free of the mandate penalty.

They could also choose to purchase a catastrophic health plan, which has lower premiums but higher out-of-pocket costs, an option available to people under age 30 and those claiming a hardship exemption. Those plans don’t cover anything other than three primary care visits per year until the deductible is met, though after that, they provide the same coverage as regular plans.

Some of the finer points of the policy are unclear from the two-page bulletin released by the administration. Is there a cutoff date for when your policy was cancelled in order to qualify for the exemption? How long will this exemption last? People are required to provide documentation that their plan was canceled, but the bulletin says only that “if you believe” the new Obamacare options are unaffordable, then you can purchase catastrophic coverage.

What does seem clear is that the administration is responding to a political dilemma baked into the Affordable Care Act. On Jan. 1, it faced the prospects of people whose policies had been canceled becoming uninsured. No matter how small that group would be, those stories could be a political goldmine for the law’s opponents.

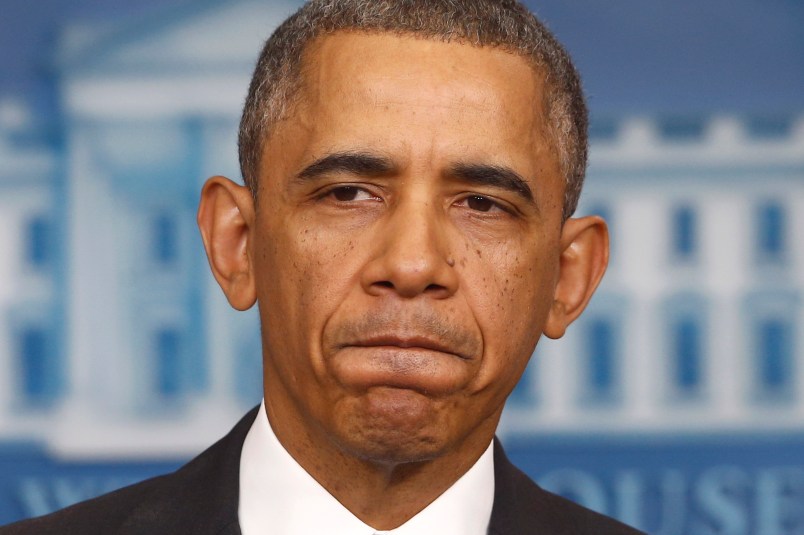

President Obama has publicly said that in retrospect the law’s provision grandfathering in existing insurance policies was insufficient and should not have been structured that way in the first place. The resulting mass cancellation of policies was a predictable outcome but one for which the administration was unprepared. The subsequent outcry forced Obama to apologize for promising that if you liked your existing insurance policy you could keep it.

Senior administration officials had estimated Thursday that the number of Americans whose policies had been canceled and were struggling to find a new affordable health plan was less than 500,000.

That number shouldn’t be enough to disrupt the market, wrote Tim Jost, a health law professor at Washington and Lee University who supports Obamacare, for Health Affairs. But the insurance companies themselves disagree. They issued a warning, without much elaboration, that the decision could be a big problem.

“This latest rule change could cause significant instability in the marketplace and lead to further confusion and disruption for consumers,” Karen Ignagni, president of America’s Health Insurance Plans said in a statement.

The potential problem is this: Insurance companies priced their catastrophic plans with the assumption that only people under 30 would purchase them. By opening that product to an older population, it puts them at a financial risk that they didn’t account for — which, if that ends up costing them more than they expected, could hurt the market broadly.

It’ll take some time to figure out if that’s true, said Caroline Pearson, vice president at Avalere Health, an independent consulting firm. People who were already part of the individual market — and therefore in a position to have their policies canceled — are more likely to be healthy and less of an actuarial risk for insurance companies if they purchase catastrophic plans.

“They were already risk-selected. They were people who were already able to buy a private plan before,” Pearson said. “I think it’s not terrible, but I also think the plans are probably upset in that they priced for the under-30’s, and they don’t have a good sense of who these new people are.”

This post has been corrected. It previously stated that catastrophic coverage was available only to people under age 30. It is available to those under age 30 and those claiming a hardship exemption regardless of age.