Despite significant media attention and expectations raised by Congress’s top tax-writers, the prospects for an overhaul of the tax code are bleak, marred by huge obstacles that even its leading champions have no answers to, let alone the ability to overcome.

The push is being spearheaded by Senate Finance Chair Max Baucus (D-MT) and House Ways & Means Chair Dave Camp (R-MI), both of whom discuss it in highly optimistic terms. But in recent days, congressional leaders have publicly acknowledged the seemingly fatal stalemate that all but puts reform out of reach.

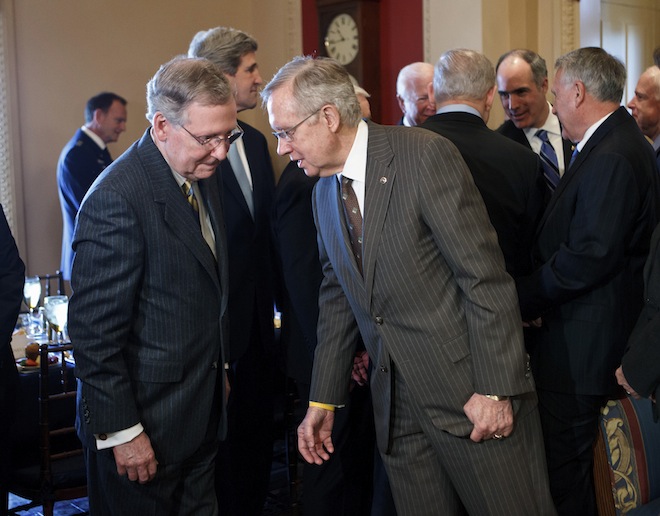

President Obama elevated talks of tax reform last week when he proposed to lower the corporate tax rate and invest in infrastructure. But Senate Minority Leader Mitch McConnell (R-KY) all but pronounced dead the prospects of a comprehensive overhaul.

“Well, I honestly don’t see how we get there,” he told reporters Thursday. “Back in the ’80s there was a bipartisan agreement between President Reagan and Speaker Tip O’Neill that the whole purpose of comprehensive tax reform was to make the country more competitive, not to raise revenue for the federal government. … So yeah, I think we’re stymied. I mean, we’re stymied by the desire of the majority to raise taxes again and that’s not what most people [want].”

“So I think we have a real stumbling block here in trying to figure a way forward,” he said.

The same fundamental divide has put any sort of broad agreement on budget issues out of reach: Republican leaders have emphasized, repeatedly, that they’ll only support tax reform if it’s revenue-neutral. And Democratic leaders have emphasized, repeatedly, that they’ll insist on raising tax revenue to help pay off the country’s debt.

“I’m totally supportive of tax reform but we’re going to have to have significant revenue, period,” Senate Majority Leader Harry Reid (D-NV) told reporters Thursday. “When it’s all over and done with, significant revenue.”

The other huge obstacle to tax reform is that it’ll require scaling back some deductions and loopholes. Middle class tax breaks like the deduction for mortgage interest and exclusion for employer-sponsored health care have tremendous political support and are highly unlikely to be touched. And upper-income tax breaks for capital gains and oil and gas companies are protected by an army of lobbyists.

Neither Baucus (who is retiring) nor Camp have been willing to pinpoint a single tax break they’d get rid of as part of a reform effort. Camp and Baucus both acknowledged the revenue divide and lacked any solutions to it when TPM asked them about it separately in June.

“Clearly we’re in different places on that,” Camp said.

“We haven’t gotten that far yet,” Baucus said.