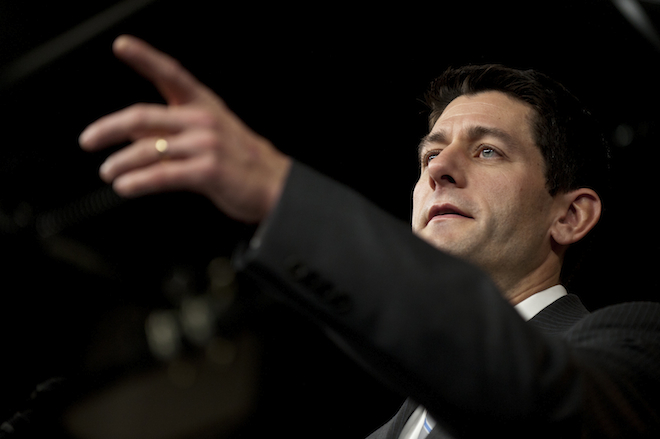

One of Rep. Paul Ryan’s many past proposals to remake the federal safety net included a sweeping plan to privatize Social Security and risk the program’s solvency in attempting to save it. He championed the idea as recently as 2010 but pushed it under the rug the following year. Mitt Romney, who recently selected Ryan to be his vice presidential nominee, is steering clear of the plan.

The proposal was in Ryan’s 2010 “Roadmap For America’s Future,” a broad blueprint to remake the federal budget which elevated the little-known congressman into the Republican Party’s visionary. It involved shifting Social Security funds to private retirement accounts as well as reducing benefits and gradually raising the age of eligibility.

Over time, the Congressional Budget Office said, Social Security payouts would “be more uncertain, despite the guarantee, because returns on stocks and corporate bonds are risky.” The plan seeks to protect against market fluctuations by guaranteeing seniors a rate return at least equal to the rate of inflation, and by shifting near-retirees’ money from stocks to government bonds. But funding losses from stock market swings could endanger the solvency of the program.

The Roadmap was the precursor to Ryan’s budgets that passed the House with overwhelming GOP support in 2011 and 2012. But unlike his Medicare and tax provisions, the Social Security reforms were dropped after Republicans won the House.

The plan would allow workers to invest more than one-third of their Social Security taxes into private retirement accounts. Wall Street would likely enjoy a huge windfall from the private account investments. The eligibility formula changes mean benefits would be cut for the top 70 percent of recipients, according to the liberal-leaning Center on Budget and Policy Priorities.

“Rep. Ryan described his plan as strengthening Social Security,” said Paul Van de Water, a Social Security expert at CBPP. “In fact, however, it would have made deep cuts in guaranteed Social Security benefits and impaired the program’s solvency by diverting a large portion of payroll taxes into private accounts that would primarily benefit high earners.”

Similar legislation Ryan co-sponsored in 2004 with Republican Sen. John Sununu would have required all participants in the private accounts, upon retirement, to buy an annuity into a portfolio established by the Social Security Administration to invest in stocks and bonds. By 2050, Social Security private accounts would have investments in the entire national market for stocks and corporate bonds, CBPP concluded. The plan would have also left a huge gap in revenues to the program’s trust fund.

Ryan’s bill was so far-reaching the Bush administration called it “irresponsible” before pushing a scaled-back version — which failed. The Romney campaign isn’t endorsing it and it’s unclear if he’d push such a plan if elected president. But the proposal offers an important glimpse into the governing philosophy of Ryan — and by extension Romney.

The Social Security trust fund has a $2.6 trillion surplus but goes underwater in 2033, according to its actuary, at which point benefits will be reduced by one-fourth.