The Senate just voted 56-38 to table Sen. Byron Dorgan’s amendment to the Wall Street reform bill that would have banned trading in naked credit default swaps, essentially eliminating a huge gambling market, wherein speculators bet on the success or failure of entities in which they have no financial interest.

That may complicate matters for Democratic leaders, who quite possibly just lost Dorgan’s vote.

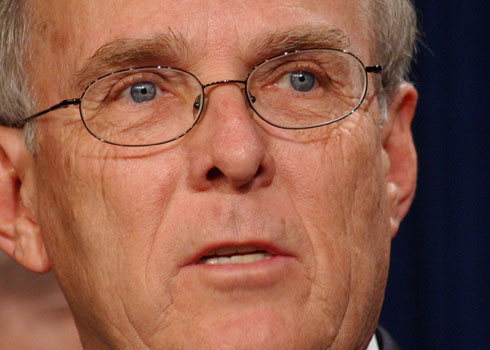

“I’m not very interested in moving a bill that doesn’t address the central issue that I want to address,” Dorgan told me a few minutes before his amendment was tabled. “But we’ll see. We’ll work tonight and see what happens.”

Dorgan’s proposal was always a longshot, but leading senators in both parties were nervous about forcing a vote on it in such an anti-Wall Street environment. In the end, Senate Banking Committee Chairman Chris Dodd used a procedural tactic to block Dorgan’s legislation from coming to a vote, making it the first amendment to be explicitly refused a vote.

And, it should be noted, other Democrats are threatening to join a filibuster of the overall bill tomorrow morning if their amendments aren’t given a hearing on the floor. More info as I get it.