News that then-Governor Mitt Romney’s office played up his predecessor’s tax hikes to secure a better rating from Standard & Poor’s may undercut his hardline anti-tax image. But the S&P story also revives a longstanding debate over Romney’s own revenue raisers as governor, an issue that takes on greater significance than it did in 2008 thanks to the recent debt ceiling talks.

On Wednesday, Politico reported on a presentation Romney’s office gave to S&P in 2004 touting the strength of the state’s budget thanks in part to a 2002 tax increase that he opposed. The presentation also highlighted higher fees and newly closed loopholes that Romney championed himself. While Romney supporters have long argued these policies should not count as tax increases, critics have long insisted otherwise and the S&P story pushes the debate into the headlines once again.

The issue of closing loopholes is especially relevant today since Republicans are resisting pressure from the White House and Congressional Democrats to use similar measures to close the deficit — ending special benefits for oil companies, for example. Small-government activists like Grover Norquist argue that any net increase in revenue amounts to raising taxes and the GOP, with some notable exceptions, has mostly closed ranks around their position.

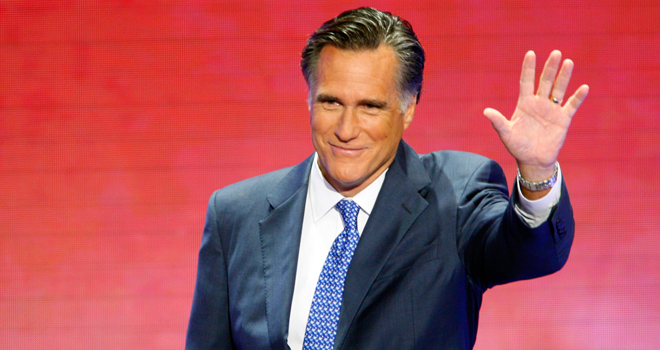

Traveling in Iowa, Romney was asked Thursday whether he would pursue these kinds of revenue-raising measures as president, prompting him to defend his Massachusetts policies and distinguish them from the national debate.

“In my opinion, a loophole is when someone takes advantage of a tax law in a way that wasn’t intended by the legislation,” he said. “And we had in my state, for instance, we had a special provision for real estate enterprises that owned a lot of real estate. And it provided lower tax rates in certain circumstances and some banks had figured out that by calling themselves real estate companies, they could get a special tax break. And we said, ‘No more of that, you’re not gonna game with the system.’ And so if there are taxpayers who find ways to distort the tax law and take advantage of what I’ll call loopholes in a way that are not intended by Congress or intended by the people, absolutely I’d close those loopholes. But there are a lot of people who use the loophole to say, ‘Let’s just raise taxes on people.’ And that I will not do.”

But anti-tax groups in Massachusetts took the same perspective on Romney’s policies at the time that Norquist has on Democrats’ latest proposals. “There’s going to be a lot of debate over the definition of what is a loophole and what is a break and what is a tax,” Romney said shortly after he took office as governor, acknowledging the pushback.

The issue came up repeatedly during his first run for president as his old foes took to the national press to undermine Romney’s repeated insistence that he never raised taxes as governor.

“It’s straightforward,” Michael Widmer, president of the Massachusetts Taxpayers Foundation, told McClatchy Newspapers in 2007. “He raised corporate taxes.”

Rudy Giuliani went after Romney in debates over the claim and it wasn’t only conservatives who took issue with the ex-governor’s record. The nonpartisan Factcheck.org concluded that while Romney’s assertion was “technically true” it was “also misleading” since he “increased state revenues significantly” overall by hundreds of millions of dollars.

Anti-tax groups aren’t keeping quiet this time around either. Club For Growth recently gave Romney a “C” on fiscal issues after concluding that he “broke his verbal commitment” to not raise taxes in Massachusetts.

With far more attention on the loophole issue in the 2012 race compared to 2008, it seems likely that the issue will linger on the campaign trail. As for the increased fees, Romney can ask Tim Pawlenty, who was hammered by Michele Bachmann in Thursday’s debate over a $.75 fee on cigarettes he approved in 2005 to end a budget crisis, how those are playing the primary.