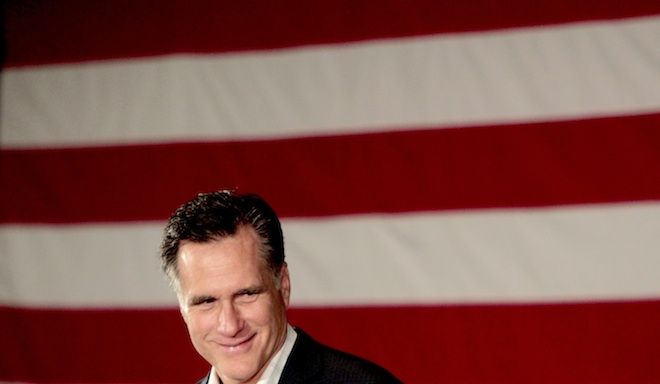

Too bad for Mitt Romney. Turns out income inequality — that thing he claims has no place in our political debate, or anywhere outside of “quiet rooms” — will be a central theme of President Obama’s re-election message. We know this because one of his top economic advisers essentially claimed as much in a public address at a top DC think tank on Thursday morning.

And the data he brought to the table suggests Democrats will have an easy time making their case.

“[W]e can’t go back to the type of policies that exacerbated the rise in inequality and threatened economic mobility in the first place if we want an economy that builds the middle class,” said Alan Krueger, chairman of President Obama’s Council of Economic Advisers. “This means that we must adequately regulate excess risk-taking and corrupt practices in financial markets. It also means that we can’t go back to tax policies that didn’t generate faster economic growth or jobs, but rather increased inequality. Instead of going backwards, we should adhere to principles like the Buffett Rule, which states that those making more than $1 million should not pay a lower share of their income in taxes than middle class families. We should also end unnecessary tax cuts for the wealthy, and return the estate tax to what it was in 2009.”

The GOP wants essentially the opposite policies — to take things further than George W. Bush was able to. And that’s why they want to keep inequality issues out of the sphere of legitimate political debate. But the problems are very real, as Krueger explained.

Below are adaptations of two charts Krueger used in his presentation.

Thirty years ago, the U.S. underwent a shift — from an economy that grew in a way that lifted all segments of society, to an economy that gives heavy preference to the wealthy. That’s the broad story of the last three decades, but as Krueger pointed out, policy has a role to play. The trend abated temporarily in the 1990s, when the country returned to an era of fairly uniform income growth distribution. That all changed for most people, and their lost income has instead trickled up the ladder.

As Krueger said, “We were growing together for the first three decades after World War II, but for the last three decades we have been growing apart…. I should point out that the pattern in the post-1970s period is not monolithic…. [T]he period from 1992 to 2000 was an exception, when strong economic growth and the policies of the Clinton Administration led all quintiles to grow together again. Indeed, all income groups experienced their fastest income growth in years…. If in the first decade of the 2000s the income of the median household had grown at the same rate as it did in the 1990s, middle class households would have an extra $8,900 a year to spend on their mortgages, rent, cars, food, and clothing, or to add to their savings.”

Just don’t repeat that unless you’re in a quiet room.