I first learned of Dani Rodrik in 1997 when I came across his pamphlet, Has Globalization Gone Too Far?. That pamphlet created a sensation in a Washington awash with “new economy” optimism. It was an opening salvo against what Rodrik has come to call “hyper-globalization.” Since then, the fissures that Rodrik saw in the global system have become crevasses. Rodrik has continually updated his own critique. His most comprehensive statement was in his 2011 book, The Globalization Paradox.

Rodrik was born in Istanbul in 1957, part of Turkey’s small Sephardic Jewish community. He came to the United States to attend college at Harvard and subsequently got a PhD. in economics at Princeton. He has taught political economy at Harvard’s Kennedy School for most of the last 32 years. Besides writing books and articles, he also has a blog, where he comments regularly on American, European, and Turkish politics. He is a noted critic of Recip Tayyip Erdogan’s administration.

As globalization has come under attack from the left and right, I wanted to ask Rodrik what he thought about the jeremiads from the Trump administration and how he assessed the problems of global capitalism in the wake of the Great Recession.

Real Grievances And Fake Solutions

Judis: During his campaign and presidency, Donald Trump has made a big issue of America’s trade deficit, and singled out China, Mexico, and Germany for blame. When Trump was in Europe recently, he attacked the Germans for having a trade surplus. He even threatened to block German car exports to the United States. Is there any basis for Trump’s complaints?

Rodrik: Like most everything with Trump, I think there is a significant element of truth in the causes that he picks up. He is addressing some real grievances. But then the manner in which he addresses them is completely bonkers. So in the case of Germany, I do think Germany is the world’s greatest mercantilist power right now. It used to be China. China’s surplus has gone down in recent years, but Germany’s trade surplus is almost 9 percent of GDP. And they are essentially exporting deflation and unemployment to the rest of the world.

I think the damage, though, is done to the rest of Europe and not the United States. In addition, it is not a trade problem. It is a macro-economic problem. The solution is to get German consumers to spend more and save less and the German state to spend more and to increase German wages. It is not the trade policies of the US or any other country that is going to be able to address this issue. It is similar to the way Trump has picked up grievances about how trade agreements have operated in the United States. These agreements have created loses, and grievances that have not been addressed, and I think there is a lot of truth to those kind of things, but I don’t think he has any realistic way of dealing with those things.

Judis: So you do think our trade deficit is a problem?

Rodrik: Yes, but I don’t put it on the top of our concerns. There have been times when it is a bigger issue. The U.S. could use more aggregate demand and one of the places it could come from is smaller trade deficit. But you could get the same result more effectively through a more aggressive fiscal stance on the part of the federal government and the states, particularly through expenditure on infrastructure. I do think the low labor force participation is something we should try to bump up and I think there is a place for increasing demand. A lower trade deficit might contribute a little bit to raising it, but I don’t think it’s where the major action is.

Judis: Do you think there is a point in trying to renegotiate the North American Free Trade Agreement (NAFTA)?

Rodrik: The damage of NAFTA has already been done. Many communities affected by NAFTA have already experienced sizable losses, but there is no way you are going to bring back the jobs that have been lost. Those are water under the bridge. So we shouldn’t fool ourselves that we can reverse the consequences of NAFTA.

If we are going to be renegotiating NAFTA, we might be able to put a symbolic stamp on a new type of trade agreement, but there is absolutely no sign that the current administration is approaching it that way. I would have let NAFTA be NAFTA. I would have put TPP on hold, and I would have articulated a new approach to trade agreements before starting on new agreements. There is a complete disconnect between what Trump said he wanted to do on trade agreements and what seems to be happening.

Rebalancing Trade Agreements

Judis: Where do you see the disconnect?

Rodrik: I don’t think Trump’s proposed remedies for the issues that he picked up from the angst, the anxiety created by jobs losses have any chance of working. I also thought from the outset his bite would be much less than his bark. That when push came to shove, he would not do some of the radical things that he said would do, like building a wall or putting 35 percent tariffs across the board on imports from China. I am glad he is not doing these things, and I think the optics at some point will look more and more awkward and at that point his base will start to wonder what is really happening with his promises.

Judis: And what should a president concerned about trade do? What are new types of trade agreement that are worth pursuing?

Rodrik: There is a kind of rebalancing we need to do in the world economy. I would put it under three major headings. One is moving from benefiting capital to benefiting labor. I think our current system disproportionately benefits capital and our mobile professional class, and labor disproportionately has to bear the cost. And there are all sets of implications as to who sits at the bargaining table when treaties are negotiated and signed, who bears the risk of financial crises, who has to bear tax increases, and who gets subsidies. There are all kinds of distributional costs that are created because of this bias toward capital. We can talk about what that means in specific terms.

The second area of rebalancing is from an excessive focus on global governance to a focus on national governance. Our intellectual and policy elites believe that our global problems originate for a lack of global agreements and that we need more global agreements. But most of our economic problems originate from the problems in local and national governance. If national economies were run properly, they could generate full employment, they could generate satisfactory social bargains and good distributive outcomes; and they could generate an open and healthy world economy as well.

This is an important issue with the cosmopolitan and progressive left because we tend to be embarrassed when we talk about the national interest. I think we should understand that the national interest is actually complementary to the global interest, and that the problem now is not that we are insufficiently globally minded, but that we are insufficiently inclined to pursue the national interest in any broad, inclusive sense. It might seem a little bit paradoxical but it’s a fact.

The third area for rebalancing is that in negotiating trade agreements, we should focus on areas that have first order economic benefits rather than second or third order. When tariffs are already very small, you do not generate a lot of economic benefits by bringing them down further. When you restrict governments’ ability to regulate capital flows and patent/copyright rules, or when you create special legal regimes for investors, you do not necessarily improve the functioning of our economies. In all these areas, global agreements generate large distributional effects — large gains for exporters, banks or investors, but also large losses to rest of society – and small net benefits, if any at all. In other words, past agreements addressing trade and financial globalization have already eked out most of the big efficiency gains. Pushing trade and financial globalization further produces tiny, if not negative, net gains.

One major unexplored area of globalization where barriers are still very large is labor mobility. Expanding worker mobility across borders, in a negotiated, managed manner, would produce a large increase in the size of the economic pie. In fact, there is no other single global reform that would produce larger overall economic benefits than having more workers from poorer nations come and work, for a temporary period, in rich country markets. Of course, this too would have some redistributive effects, and would likely hurt some unskilled native workers in the rich nations. But the redistribution you’d get in this area per dollar of efficiency gain you’d generate is small – much smaller than with trade liberalization, greater capital mobility, or any other area of the world economy. This may seem paradoxical, but it is an economic fact. This is a major reorientation in our global negotiation agenda we need to think about.

Skepticism About Global Governance

Judis: Let me go through these three kinds of rebalancing more specifically. Let’s talk first about the movement toward global governance. In The Globalization Paradox, you express skepticism about global government and hyper-globalization, and you advocate a movement backward toward a new Bretton Woods, the monetary agreement that the World War II allies signed in 1944 and that governed global capitalism for three decades. Bretton Woods allowed nations a great deal more latitude in stimulating their economies and control capital flows. Explain that more clearly.

Rodrik: My starting point is the view if you have well functioning markets, you need to embed them in institutions of governance. Markets aren’t just created on their own. You need to stabilize markets and legitimatize markets, and the wonderful thing about capitalism over its long history is that we have learned how to do that for national markets. We have national political systems that provide stabilization, regulation, and legitimation.

Now what happens when your markets are global? Who is going to provide those supporting institutions? You can’t really have fully integrated international markets without all fully integrated political systems. You can’t have an imbalance between the scope of markets and scope of political accountability and political institutions. But we end up relying on global agreements and global commissions that essentially become technocratic arrangements with no political or social content to them.

Nationally we have democratic institutions for deciding who benefits from markets and how resources and income are to be distributed. Internationally, all we have are tool shops and arrangements whereby trade lawyers and technocrats decide on a global agenda without any of the legitimacy or authority that you have at the national level. When you look at it from that perspective, I am not surprised at the backlash against the international arrangements that were created in the 1990s and that have led the push to globalization.

Wrong Turns In The 1990s

Judis: Are you saying that in the ‘90s, the United States should have been much more wary and cautious when it helped to found the main international trade group, the World Trade Organization (WTO), in 1995?

Rodrik: A lot of wrong turns were taken in the 1990s. The WTO had some good things in it, but as a trade regime, it exemplifies global overreach. It tries to fix global standards for intellectual property rights, industrial policies, and various health and safety regulations. As a result, it reached into areas that are more properly a national responsibility and where the argument for global harmonization is quite weak. It was bad economics that resulted in a loss of legitimacy for the global trade regime.

Another wrong turn came in what the United States didn’t do when it opened its economy with NAFTA, the WTO, and then the entry of China into the WTO. At some point, the United States could have done what Europe did in an earlier stage in this history when Europe became an open economy. That is to erect very generous social insurance and safety nets. The kind of insecurities and anxiety that openness to trade creates can be compensated or neutralized by having extensive social policies, and that’s what Europe managed to do.

Europe is much more open to trade in the United States. Yet to this day, trade remains uncontroversial in Europe. When you look at populism in Europe, it’s not about trade at all. It is about other things, it is about immigrants going to reduce the welfare state.

Judis: But aren’t populists in southern Europe and France up in arms about Germany and its trade balance?

Rodrik: It’s about macro finance, it’s about the role of Brussels, it is not about putting trade restrictions on China and Mexico. In Britain, the Brexiteers wanted to leave Europe in part so that they could pursue free trade policies unencumbered by Brussels. The issue of trade and import competition was largely neutralized as a political issue in Europe by the tradeoff of a generous welfare state. When the United States became an open economy in the ‘80s and ‘90s, it largely went the other way. We didn’t try to erect a stronger safety net. If anything, the safety net was allowed to erode. That I think was a major wrong turn and we are paying the price for that now.

Judis: If you look back at the 1996 election, and Bill Clinton’s speeches, when he said change is our friend, he was saying what you’re saying. He was talking about a more generous welfare state, mainly in terms of education and health care. And in his second term, before the Monica Lewinsky scandal broke, and Republicans began impeaching him, he wanted to expand Medicare, and other programs,

Rodrik: You’re right, there was a fork in the road. I do remember that. I remember my stuff getting cited at that time [Has Globalization Gone Too Far? came out in March 1997], but in fact there wasn’t much action. There was a general problem even with the center-left. You heard let’s liberalize finance and let’s do trade agreements and don’t worry then we’ll have compensation and the education and the transfers. In the end, we got a lot of the first and very little of the second, and that’s how I think the center lost its credibility.

The Problem With Global Finance

Judis: There is another aspect to your analysis. You are not saying simply that we can have these open economies if we also have generous welfare states. You are also saying in The Globalization Paradox that there is a problem with the model of the open economy. You talk about the need for capital controls and for countries to undertake industrial policies without violating the WTO. You are saying there is something wrong with a completely open global economy.

Rodrik: I think that’s right. I think what we should have is a moderate degree of openness. I don’t think anybody wants to cut their country off from international trade and finance and international ideas and technology, but what we have learned is that the successful relationships between a country and the world economy are always managed. They are not just a matter of removing barriers by a stroke of the pen, believing that good things will follow.

If the trade agreements were about free trade, they would be one sentence long. They are thousands of pages, because they consist of a new set of regulations. And the question then becomes what are these regulations for, whose interests are they advancing.

No country has a completely free trade policy. There is always some management of trade. We don’t let goods come in that don’t satisfy our health and safety standards, that go beyond our regulatory standards, so we always have these controls. It’s never about free trade vs. protection. It’s always about where we should and shouldn’t regulate.

And the same is true about capital markets, and financial globalization. I think we have too easily internalized the norm that financial capital should be free to move without any restriction. There is no justification in economic theory for the idea that free capital mobility is optimal. These are things we know we need to approach pragmatically. There are real decisions that need to be made.

Judis: Let’s talk about capital controls and this idea of global finance. What are capital controls, and what has been the effect of eliminating them?

Rodrik: In the Bretton Woods regime, nations put restrictions on the flow of capital both inwards and outwards, so that domestic firms and banks could not borrow from banks elsewhere or from international capital markets. They would ask for permission or they would not be permitted. Domestic corporations or banks could not put their money in other countries. They couldn’t simply take the money out.

What that meant was that domestic financial markets would be segmented from international or financial markets elsewhere. That gave you the ability to run your own macroeconomic policy without being truly encumbered by monetary or fiscal policies elsewhere. It also meant that you could have your own tax policies, your own industrial policies without having to worry that capital and international capital would leave. It meant you didn’t have to constantly look over your shoulder and try to seek market confidence for every policy. You didn’t have to worry that if you didn’t have market confidence, capital would flee.

Judis: Were there currency speculators then as there are now that drive the price of a currency suddenly up or down?

Rodrik: There were restrictions on domestic residents trading on foreign currencies. You couldn’t buy and sell foreign currencies without going through your own central bank and you were restricted how much foreign currency you could buy. I think a lot of these restrictions in the 1950s and 1960s may have been excessive, but I think we went from the norm being that every country would have capital controls to run sound economic policies, which was a consensus view among the economists, to the 1990s where the consensus view became that every country should have free capital mobility, and if they didn’t have now, they should move to it.

Judis: So what has been the effect of having free capital mobility?

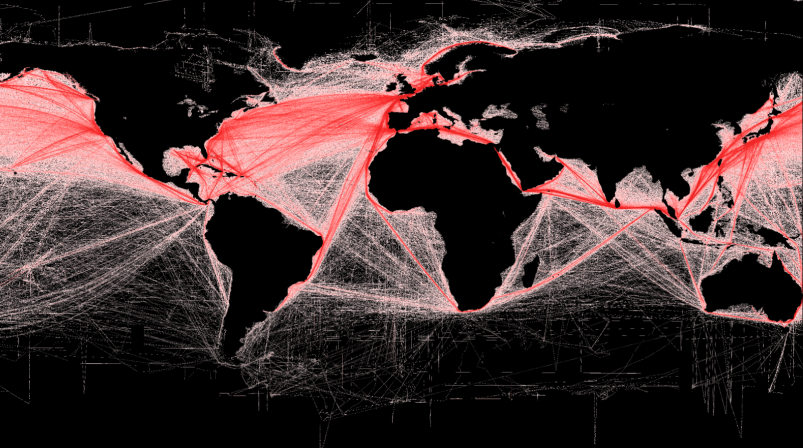

Rodrik:. The most important effect has been to exacerbate financial crises. Even without international capital mobility, financial systems are always subject to boom and busts. Financial panics and crashes have always been with us. But if you were to put on the same chart two trend lines, one having to do with the degree of international capital mobility, how free is capital to move, and another trend line having to do with the incidence of banking or sovereign debt crises around the world, those two trend lines would essentially match up.

The more financial globalization there has been the greater incidence of financial crises as well as their severity. There was a time when you looked at these things, when Mexico or Brazil or Russia or India were going through financial crises, and you said there is a problem with those countries, they mismanaged their economies, but when the United States or the Eurozone were having their crises, you suddenly knew that there was something systemic going on, that it was in the nature of the free flow of capital.

The Power Of Banks And Multinationals

Judis:. When you think of what is going on now, what can be done? Is the genie out of the bottle the way you said it was with NAFTA?

Rodrik: I think there is a recurrent and ongoing issue with capital flows that is unlike NAFTA. I think it is important to realize that many economists and even the IMF have revised their view on the desirability of free capital mobility. The IMF has come to accept that there is a role for continued capital controls.

There have been tons of caveats. They should only be used as a last resort and so on, but they have gone from saying every country should free up capital mobility, to saying there might be a role for capital controls. So I do think this is an area where intellectually some progress has been made.

I think we need countries to be willing to be much more aggressive and experimental in their willingness to apply capital controls. Something else we have learned is that there is difficult to be surgical when you are talking about capital controls, because capital is extremely fungible, and there are all kinds of ways that you can evade capital controls that are very finely tuned and very finely targeted.

Judis: Is there something that is preventing countries from imposing capital controls? Why don’t countries go back to using them?

Rodrik: There is a tremendous amount of hesitation for two reasons. One is a genuine concern of states that you don’t want to be the country that is applying capital controls. I think those who make decisions still worry a lot they will be stigmatized if they were to use capital controls.

The second is the same underlying cause for a lot of the problems we are talking about, which is asymmetric political power — that is, whose opinions get listened to. The banks and multinationals and financial interests have a huge amount of influence and they are able to simultaneously argue to governments and policy makers that imposing capital controls will be very costly, and that if you do them, we can easily evade them. Sometimes they use one argument, sometimes the other. I think they still have enormous sway on policy and politicians.

Trade And The Social Dumping

Judis: So we are get down to nitty-gritty Let’s go back to the three steps for rebalancing trade agreements and to American trade policy. Do you think Trump was right to abandon TPP?

Rodrik: Yes.

Judis:. There are a lot of people who thought it was a good idea on geopolitical if not economic grounds. It was a way to strengthen America’s position in Asia against that of China.

Rodrik: I think many people thought the economics was unimportant and that geopolitically it was a way of getting Asia to play by American rules and counterbalancing China and so forth. Whether that is good or not, whether that made sense or not from geopolitical standpoint, I think it is crazy to have a trade agreements which is extremely contentious politically and which contains a lot of elements that are highly problematic and use it for geopolitical reasons. If you want to achieve a geopolitical agreement not an economic agreement, do that. I think it was very dishonest and very inappropriate.

On the economics, it is another instance of a trade agreement that would have produced aggregate gains that were really miniscule. The best that the most pro-TPP economists could produce was an estimate that it would increase US GDP 0.4 percent after 10 years. And that included all kinds of assumptions of how employment would not be affected and workers would move to new jobs and new opportunities and so forth, stuff we know from earlier that we doesn’t happen, Even in the best circumstances, the overall gains were miniscule.

Then it had really problematic elements. The one I find the most problematic in these new trade agreements is the ISDS, the investor state dispute settlement, which is an abomination. [The TPP would have established independent tribunals that corporations could use to file suit to overturn national regulations.] I think it is a derogation of domestic legal standards and it undermines the integrity of a domestic regulatory and judicial system.

Judis: You talked earlier about changing trade agreements so that they reflect the interests of labor rather than capital. But the main thing you mentioned in explaining it is allowing increased visas for guest workers. That wouldn’t seem to benefit a host nation’s workers. Look at the abuse of H-1B visas in the United States.

Rodrik: That’s true. But is also depends on how you manage it. If am a worker in the United States or Europe, would I rather compete with a Bangladeshi workers who is working in Bangladesh under Bangladeshi labor standards and rules and exporting goods into my market or would I rather compete with him in the United States or Europe earning American and European wages and operating under our labor standards? I would much rather than have the second.

Temporary labor mobility schemes would regularize something that is already happening, but informally and with much greater damage to labor markets and countries. They would also improve labor standards of the workers with whom you are competing. I would add it’s not only about guest worker schemes. It is also about much better safety nets. It’s about social dumping.

Judis: What is social dumping?

Rodrik: We have remedies against dumping when a foreign country sells things below cost. You protect your domestic company by putting tariffs on the importer who is dumping. Now we often subject our workers to competition with workers elsewhere who are working under very dangerous or substandard labor regulations. These are workers who don’t have bargaining rights and so forth. I think in those cases there is an argument we should have a parallel trade remedy that allows for a policy to protect American or European workers from unfair competition.

We protect workers from competition from other domestic workers. I can’t hire workers in the United States who work below minimum wage, but I can compete back door by outsourcing to a company in Bangladesh and doing it that way. So social dumping is essentially a mechanism that undermines domestic labor standards and other norms. Preventing it would be one way of changing the rules to make them more symmetric with respect to how we treat businesses and workers.

Judis: A lot of things you are proposing are difficult politically. It would be very hard to get an agreement on social dumping given the power of banks and multinationals. Where do you see changing coming?

Rodrik: I think the change comes because the mainstream panics, and they come to feel that something has to be done. That’s how capitalism has changed throughout its history. If you want to be optimistic, the good news is that capitalism has always reinvented itself. Look at the New Deal, look at the rise of the welfare state. These were things that were done to stave off panic or revolution or political upheaval.

I don’t want to overdramatize but I think in some ways we are at the cusp of a similar kind of process. You have the populists at the gate, and the centrist political figures and the powers behind them are looking for ways of maintaining the system, and I think they realize they need to make adjustments.

We say we wonder how the people that benefit from the system, the multinationals, the high tech companies, will ever be willing to change, but we forget where these people get their idea of what their interest is. They operate with a particular narrative. The way to change the way they act is to change their ideas of what their interests are.

I think this might be a moment where this is happening. They are seeing the process they believed was perfect is not so perfect. And they see that if nothing is done, there are going to be a bunch of rightwing populists and nativists and xenophobes who are going to gain in power.

So I think the powerful interests are reevaluating what their interest is. They are considering whether they have a greater interest in creating trust and credibility and rebuilding the social contract with their compatriots. That is how to get change to take place without a complete overhaul of the structure of power.

Dani Rodrik has always been one of the real smartest people in the room. That last line sure is a polite kicker.

Capital is fungible, but labor is not. However, capitalists think it is.

What’s wrong? There’s two separate economies (and a 3rd, I suppose, if you count 3rd world countries with almost no economic resources etc.): one for the extremely wealthy and another for the rest of us. The financial systems have been designed as a one way street/valve/door…it all goes up and never comes down.

The Russian aristocracy thought the serfs came with the land, and you owned both.

Can someone please get John Judis an editor, or a hand-holder, or something? The edblog blurb gives zero indication of what this article is about, just referring to it as “Globalgate” (wtf?), and on top of that doesn’t even provide a link.