Several House Democrats with close ties to the financial industry, including four members of the conference committee hashing out the final bill, are pushing to weaken the Wall Street reform legislation in the conference committee.

The 68-member New Democrat Coalition has been circulating drafts of a letter outlining their position on financial regulatory reform, proposing to significantly scale back regulations on derivative trading, and open up exceptions to the so-called Volcker rule, which limits financial firms’ ability to speculate with their profits.

One draft of that letter, obtained by TPM, can be read here. Their position on derivatives provoked the ire of Americans for Financial Reform, the largest pro-regulation coalition in the country, which responded yesterday with a letter of their own.

“We strongly disagree…with the letters’ analysis of the legislation,” AFR’s letter reads. “Strong derivatives regulation is key to preventing future financial crises, and we are convinced that the Senate language is needed to accomplish this goal.”

Because of the conference committee’s complex rules, the Wall Street friendly House members negotiating the final bill have little power to alter the rules on derivatives, which already appear in the base bill. Of greater concern to reformers on the Hill and in advocacy groups is their position on the Volcker rule, named after former Fed chair, and Obama adviser Paul Volcker, and authored by Sens. Carl Levin (D-MI) and Jeff Merkley (D-OR). That provision isn’t in the base bill yet, and that gives the House Dems greater latitude to meddle with it before it’s offered as an amendment.

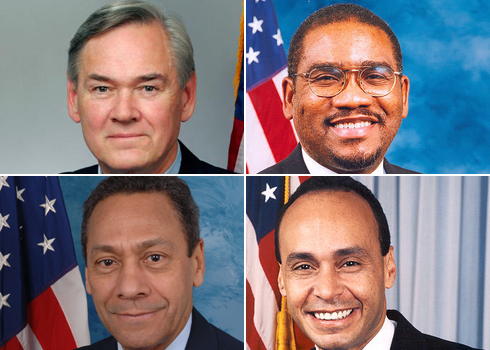

Two sources identified four House members on the conference committee–Reps. Dennis Moore (D-KS), Gregory Meeks (D-NY), Mel Watt (D-NC), and Luis Gutierrez (D-IL)*–who have privately pushed to write a loophole into the Volcker rule which would allow banks to invest in hedge and private equity funds. That loophole has the strong backing of Bank of New York Mellon, and State Street Bank and Trust among other firms, but is fiercely opposed by Volcker himself, who has had tremendous influence over the shape of the reform bill up to now. Volcker was supposed to meet with the Democrats yesterday to warn them away from supporting this loophole, but the meeting was canceled at the last minute.

Spokesmen for the four congressmen did not immediately respond to requests for comment, though they noted that negotiations are fluid and no final decisions have been made.

The wrangling over the provision exemplifies just how opaque the negotiations over reform can be, even during an open conference committee such as this one.

The underlying Wall Street reform bill has a weak version of the Volcker rule in it, which by numerous accounts is supposed to be replaced with Levin and Merkley’s beefed up version. But for that to happen, according to conference rules, House members on the committee must first propose it–and these Reps have toyed with the idea of allowing banks to invest 5 percent of their capital in hedge funds.

“An amount that’s five percent of capital in a healthy financial market could quickly become 25 percent of capital in a crisis when financial assets are suddenly devalued,” warns Heather McGhee, Director of the Washington office of the policy and advocacy group Demos, and a member of AFR.

The rules allow the Senators on the conference committee to strike whatever exemption the Wall Street friendly House members manage to add–except for one problem: Sen. Scott Brown (R-MA) is strongly in favor of the loophole, and as the 60th vote for financial reform, he has tremendous sway over what does and does not make it into the final bill.

If you need a real world example of the risk the loophole poses, look no farther than Bear Stearns.

“Bear Sterns invested $34 million in a hedge fund that they ended up bailing out for $3.2 billion,” McGhee says.

Conversations between members and supporters of a strong Volcker rule are still ongoing, so nothing’s yet set in stone. One of the House Dems–Mel Watt–is under investigation by the Office of Congressional Ethics for a fundraiser he held in the days before the House passed its Wall Street reform bill. The Conference Committee will officially (and publicly) address both derivatives and the Volcker rule next week.

*Late update: Gutierrez’s spokesman Doug Rivlin calls to say that his boss hasn’t taken a position on the Volcker rule. “Volcker rule isn’t something that he’s been working on,” Rivlin says, noting that Gutierrez’s main concern is with the portion of the reform bill dealing with resolution authority. Gutierrez wants a liquidation fund to be created in advance of the failure of any systemically significant financial firm–the Senate bill calls for those funds to be raised in the aftermath of a failure.