Every year the U.S. Energy Information Administration releases an Annual Energy Outlook, which presents an objective examination of energy trends and serves as a starting point for the media and policy community’s analyses of U.S. energy regulations.

The American Petroleum Institute (API) has developed an interactive tool that combs through the data from 2014 and 2015 reports and lets users select hypothetical energy scenarios and visualize their effects in easy-to-interpret charts and graphs — sort of a “Choose Your Own Adventure” for energy policy.

What could happen if the U.S. implemented a tax of $25 per metric ton on carbon dioxide (CO2) emissions starting in 2015? These charts, generated using API’s interactive tool, answer that question. If a $25 carbon tax is implemented and remains in place through 2040, EIA predicts the U.S. will likely see a decrease in carbon emissions. However, energy prices will spike and there will be 1.2 million fewer manufacturing jobs than there were in 2012.

Energy prices rise much faster with a carbon tax

This chart, created using API’s interactive tool, illustrates how energy prices will change over the next two decades if a tax is enacted starting at $25 per metric ton. According to EIA projections, a $25 tax would increase prices by 39% compared to their 2012 levels by 2040. This increase will be passed onto consumers. For an average family of four, this translates to a $500 per year increase in energy bills, plus an increase of about 10% in the cost of gas. These costs could increase even further if not for technological advances in the energy sector, such as more advanced building codes that will keep heating costs lower over time, as well as the continued availability of cheap natural gas. Low and middle income families will bear the greatest burden of these price increases. About half of American households have a pre-tax income of $50,000 or less, and on average, these families spend 17% of their take-home pay on energy for the home or for transportation.

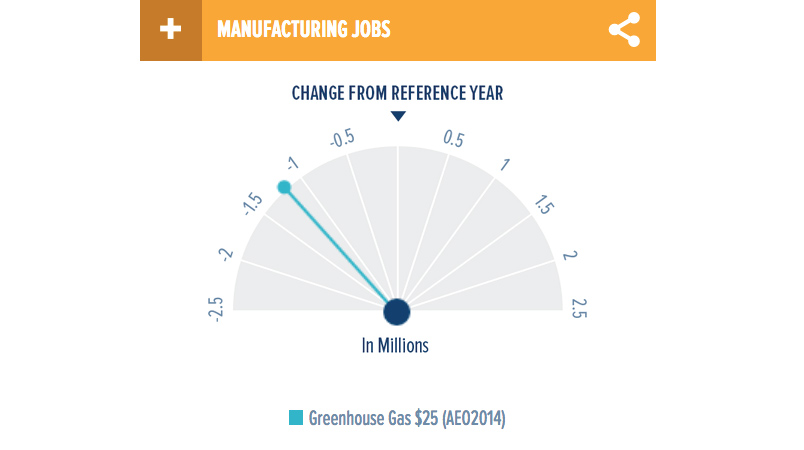

Manufacturing jobs decline

This chart, created using API’s tool, shows that there will be 1.2 million fewer manufacturing jobs in 2040 than there were in 2012 if the United States were to implement a carbon emissions tax starting at $25/ton with a 5 percent annual increase. As the tax continues it will amplify a long trend of declining manufacturing jobs; the number of Americans employed in manufacturing has declined by over 30 percent since 2003. Throughout much of the 20th century, the middle class in our country grew thanks to stable manufacturing jobs that paid good wages to people of all walks of life. According to the EIA, if a carbon tax is implemented, the loss of U.S. manufacturing jobs will accelerate by a quarter.

As the price of CO2 emissions goes up, the amount emitted drops

This chart shows how, with API’s data tool, users are able to cross-reference numerous hypothetical energy scenarios. The chart above is the result of crossing the “No Greenhouse Gas Concern” scenario — which simulates what would happen if the U.S. were to take no policy action to address carbon emissions — with the $25 carbon tax scenario outlined in the preceding charts. As the chart shows, if we do nothing to address carbon emissions, carbon dioxide (CO2) emissions in the United States will increase only slightly over the next two decades thanks to a shift from coal to lower-carbon natural gas and overall advancements in energy technologies.

With a carbon tax starting at $25 per ton, the EIA projects that emissions will be lower in the United States in 2040 than they were in 2012. Experts disagree, however, on how much this decrease in U.S. emissions will affect the global climate. Since 1990, the world stock of emissions has flipped from mostly coming from countries like the U.S. and EU to now mostly coming from countries like China and India – in 1990 62% of emissions came from the developed world and 34% from the developing world but in 2013, only 36% came from the developed world and 58% came from developing countries. Additionally, many experts believe that reduced U.S. demand for fossil fuels as a result of the tax would result in lower global prices for those fuels, making them more attractive in unregulated countries.

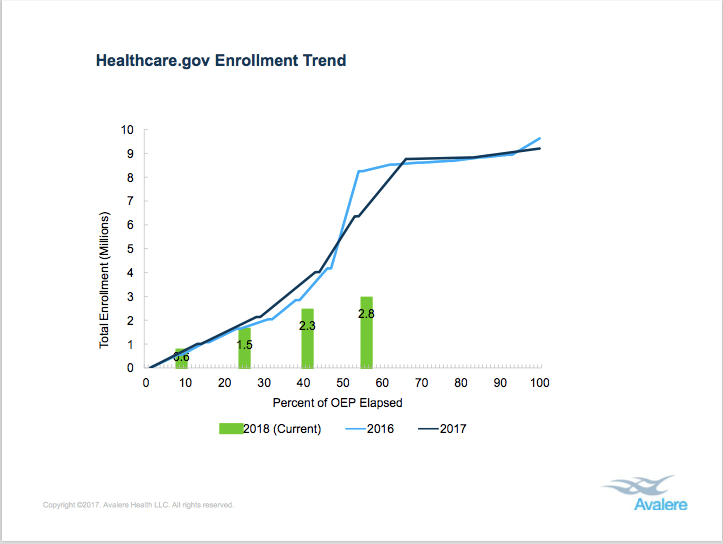

GDP jumps, but a greenhouse gas tax has no effect

This chart illustrates how real GDP is projected to roughly double between 2012 and 2040, regardless of whether a tax is instated on greenhouse gas emissions. Proponents of the tax say that the new revenues will increase GDP by putting the money back into the economy in the form of tax cuts or credits for individuals and businesses, and they say the revenues could even be used for deficit reduction. However, the chart above shows a less than 1 percent variation in GDP growth between 2012-2040, whether there is a carbon tax or not. The EIA expects GDP to grow regardless thanks to improvements in technology and services, an improved trade position for the US, and modest growth in labor costs.

You can dig into the EIA data yourself using the tool below.