Two good government groups have formally asked the IRS to investigate the actions of Crossroads GPS, Priorities USA, American Action Network and Americans Elect, who they say should be inelligible for tax exempt status.

Under the Internal Revenue Code, officials with the Campaign Legal Center and Democracy 21 write, section 501(c)(4) organizations “are required to primarily engage in the promotion of social welfare in order to obtain tax exempt status.”

“Court decisions have established that in order to meet this requirement, section 501(c)(4) organizations cannot engage in more than an insubstantial amount of any non-social welfare activity, such as directly or indirectly participating or intervening in elections,” they wrote in a letter.

“Thus, the claim made by some political operatives and their lawyers that section 501(c)(4) organizations can spend up to 49 percent of their total expenditures on campaign activity and maintain their tax exempt status has no legal basis in the IRC and is contrary to court decisions regarding eligibility for tax-exempt status under section 501(c)(4),” they write. “An expenditure of 49 percent of a group’s total spending on campaign activity is obviously far more than an insubstantial amount of non-social welfare activity.”

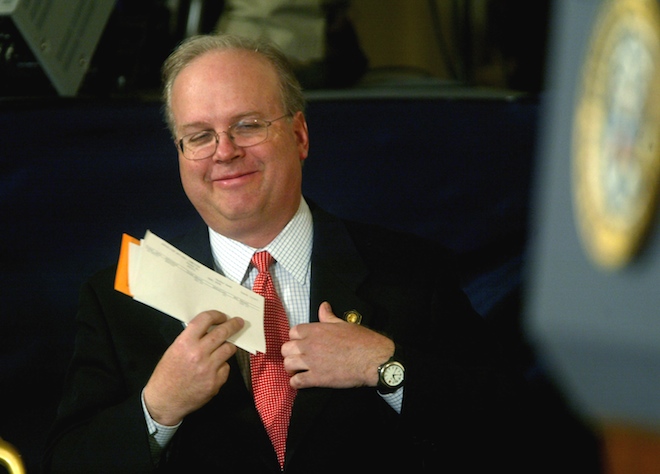

The groups being targeted by the Campaign Legal Center and Democracy 21 span both sides of the aisle. Karl Rove and Ed Gillespie launched Crossroads GPS, while Priorities USA was started by former Obama aides as its Democratic counterweight. American Action Network, headed by former Sen. Norm Coleman, shares office space with Crossroads. The other group, Americans Elect, bills itself as a political party that allows voters to nominate a candidate for the 2012 election over the Internet.

In their letter, the Campaign Legal Center and Democracy 21 argue that these organizations “cannot engage in more than an insubstantial amount of activity that is not in furtherance of its social welfare function.”

“The ‘insubstantial’ standard established by the courts certainly does not allow a section

501(c)(4) organization to spend up to 49 percent of its total expenditures in a tax year to

participate or intervene in elections and still maintain its tax-exempt status, as some practitioners believe,” they argue.

Read the full letter here.