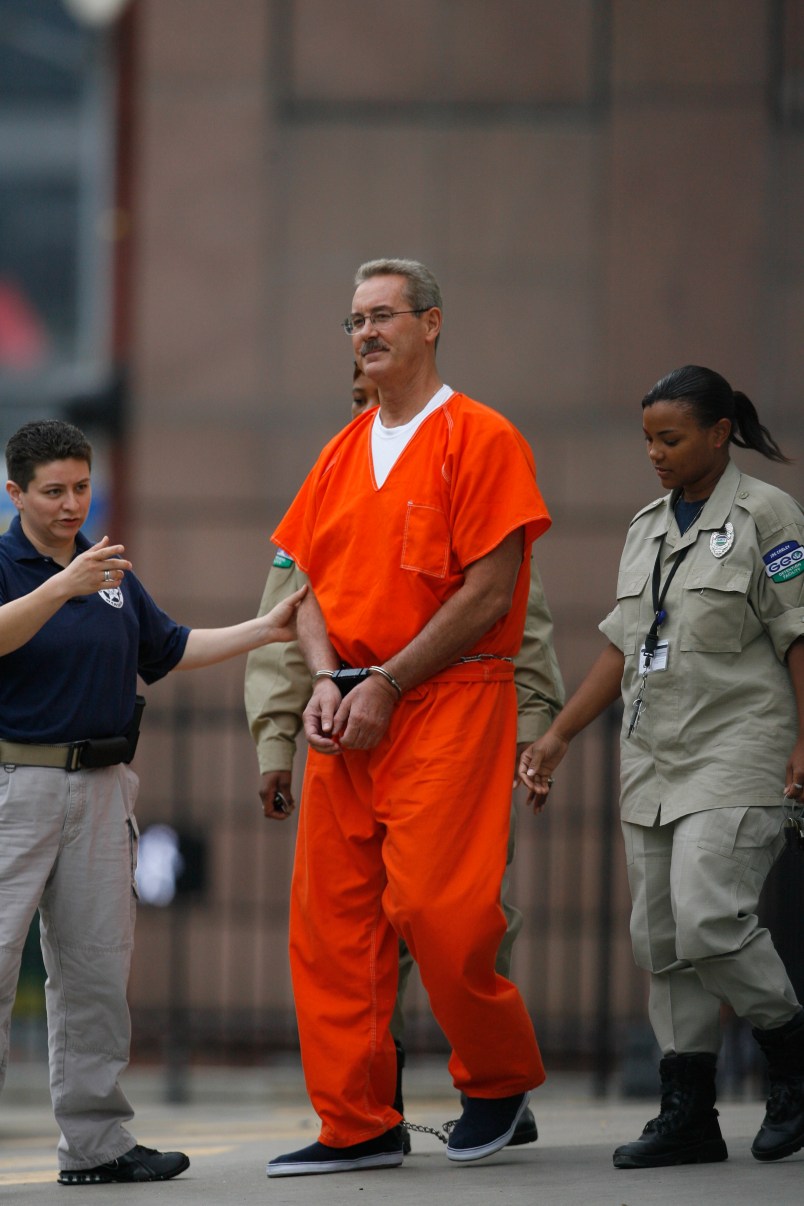

The Justice Department has opened an investigation into whether members of Congress did special favors for Allen Stanford, the Texas banker charged with running a multi-billion dollar Ponzi scheme, McClatchy reported Sunday.

So what specifically might DOJ – which hasn’t confirmed that the probe is underway — be looking at?

Over the last decade, Stanford forged close ties to lawmakers of both parties, making generous campaign contributions and organizing Caribbean trips. At the same time, his Antigua-based company was lobbying hard to preserve tax loopholes, and fight efforts to regulate offshore tax havens — efforts which could have led to the exposure of Stanford’s alleged fraud.

So on the broadest level, it’s safe to say that any investigation would consider whether members of Congress ever agreed to take action on behalf of Stanford’s priorities, in return for campaign cash, gifts, or other perks. But as part of that line of inquiry, the “Caribbean Caucus” would likely draw scrutiny. That’s the bipartisan group of lawmakers that Stanford essentially created, ostensibly to focus on issues of concern to the Caribbean region. Caucus members — including former congressmen Bob Ney (who served jail time after being convicted in the Abramoff scandal), Tom Feeney, and John Sweeney, as well as current members Gregory Meeks, Pete Sessions, and Donald Payne — enjoyed lavish trips to the Caribbean that were paid for by the Inter-American Economic Council (IAEC), a non-profit group funded primarily by Stanford. (Ramon Zertuche, the IAEC’s executive director, did not immediately respond to a request for comment.)

One Caribbean Caucus member, Sessions, appears to have been very close to Stanford. “I love you and believe in you,” the Texas Republican wrote to the banker after Stanford had been charged with a massive Ponzi scheme. But no evidence has yet emerged that Sessions took any specific action on Stanford’s behalf, and the congressman has denied doing so.

The only clear potential example of a member of Congress agreeing to take such action comes from a related McClatchy story, also published Sunday. According to that report, Stanford asked Meeks to urge Venezuelan president Hugo Chavez to prosecute an executive of Stanford’s Venezuelan bank, who was threatening to expose Stanford’s alleged Ponzi scheme — and Meeks agreed to do so.

Meeks, who hasn’t responded to the story, may have been an especially useful ally for Stanford, beyond his apparent access to Chavez. The New York congressman sits on the the House Financial Services committee, which oversees companies like Stanford Financial, and writes laws regulating offshore banks.

In 2004, Meeks told Newsday that a recent Caribbean trip paid for by the IAEC was designed to “ease Patriot Act restrictions on offshore banking,” and “to explain the hardships the act has imposed on Caribbean banks.” In other words, Stanford wanted to persuade lawmakers not to crack down on tax loopholes that benefit offshore banking, and may have helped him evade scrutiny from regulators.

But Stanford’s efforts to curry favor with lawmakers didn’t stop there. As we’ve reported, the 9/11 attacks gave a boost to efforts to crack down on money laundering and fraud. In 2001, the House passed the Financial Services Anti-Fraud Network Act, which would have streamlined financial fraud enforcement, by creating a computer network linking the databases of state and federal banking, securities and insurance regulators. But the bill died in the Democratic-controlled Senate in 2002. Stanford’s firm gave more than $800,000 that cycle to the Democratic Senatorial Campaign Committee, and thousands more to key Democrats on the Senate Banking committee like Chris Dodd and Chuck Schumer. According to online records, Stanford Financial appears to have raised $16,000 for Dodd at two fundraising events in August 2002 and March 2003.

We’ve also told you about a 2007 bill, the Stop Tax Haven Abuse Act, which would have closed offshore tax loopholes and forced companies to disclose far more information about their operations. It specifically listed Antigua as one of the jurisdictions likely being used for tax evasion. And one expert told us it likely would have rooted out Stanford’s alleged fraud. But this bill died in the Senate Finance committee, where it never came up for a vote. Committee chair Max Baucus’s office told us in February that he preferred a different approach to cracking down tax fraud, and he held hearings on the issue in March.

It’s worth saying: The Meeks-Chavez story aside, there’s no evidence whatsoever that any of these lawmakers took action on Stanford’s behalf. And senators like Dodd, Schumer, and Baucus, don’t appear to have close relationships with the indicted banker.

But if nothing else, it’s clear there was a lot Stanford wanted out of Washington, and that he worked hard to get it.