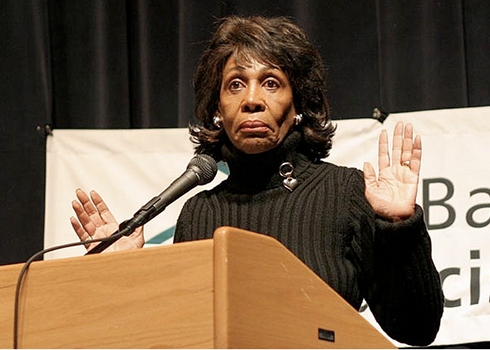

At the heart of the ethics investigation into Rep. Maxine Waters (D-CA) — which today yielded a Statement of Alleged Violation against Waters — is her connection to the California-based bank OneUnited and its receipt of TARP funding in 2008. A new investigation by students at American University details the timing of those transactions, and calls into question some of the assumptions at the heart of the investigation.

Waters’ husband, Sidney Williams, served as a director at OneUnited — which bills itself as “the first Black internet bank and the largest Black owned bank in the country” — until April 2008. He also owned a significant quantity of stock, which the committee valued as $350,000 as of June 2008. That amount represented, according to financial disclosures, between 4.6 and 15.2 percent of the Waters’ assets.

According to the Ethics Committee, around September 7, 2008 — the date that the government took over Fannie Mae and Freddie Mac — OneUnited CEO Kevin Cohee contacted Waters to ask for her help in setting up a meeting with officials at the Department of Treasury regarding the takeover of Fannie Mae and Freddie Mac. That takeover resulted in total losses to all Fannie and Freddie stockholders, including OneUnited.

In fact, unlike many other struggling banks in 2008, OneUnited’s biggest problems didn’t stem from mortgage-backed securities or subprime loans — according to the company, OneUnited didn’t engage in subprime lending. Instead, they were heavily invested in Fannie Mae and Freddie Mac, and their Tier I capital was decimated by the government’s takeover and decision to not make investors whole. But, according to the AU investigation, OneUnited’s troubled asset ratio — that is, the ratio of troubled mortgages and foreclosed properties to its Tier I capital — was only 56 percent in March 2010. Many other TARP recipients and failed banks had ratios of troubled assets to Tier I capital of well over 100 percent, indicating that OneUnited wasn’t the most troubled bank in TARP by some standards.

Waters called the Treasury Department on September 8, 2008 and arranged the meeting with Treasury for the National Bankers Association, a trade organization for minority- and women-owned banks of which OneUnited was a member. Though the AU investigation and Ethics Committee disagree whether anyone but OneUnited officials were in attendance, a group representing NBA and including executives from OneUnited met with Treasury Department officials on September 9, 2008 to discuss the impact of the Fannie and Freddie takeover on minority-owned banks. She then directed her chief of staff, Mikael Moore, to follow up on the results of the meeting.

At the meeting, the participants discussed whether Treasury could do something to help recoup their investments, but were denied.

On October 3, 2008, Congress passed the TARP, and OneUnited began to seek private capital and a tax credit waiver from the FDIC as part of its application for funding, according to the Ethics Committee. According to the AU investigation, the FDIC and Massachusetts Division of Banks issued a cease-and-desist order to the bank on October 27, 2008 over some of its practices and issued a corrective letter. It was ordered, in part, to increase its Tier I capital ratio to 5 percent; its Tier I capital ratio, which includes stock and disclosed reserves, was hit hard by the banks losses to Fannie and Freddie. The bank’s Tier I capital ratio, according to the AU investigation, remains under 5 percent.

The AU investigation indicates that OneUnited was one of the earliest — though not the only — bank to qualify for TARP funds with a low Tier I ratio. The Ethics Investigation notes that part of the TARP was specifically set aside for “financial institutions, including those serving low- and moderate-income populations and other underserved communities, and that have assets less than $1,000,000,000 , that were well or adequately capitalized as of June 30, 2008, and that as a result of the devaluation of the preferred government-sponsored enterprises stock will drop one of more capital levels, in a manner suffiicient to restore the financial institutions to at least an adequately capitalized level.” In other words, small banks like OneUnited that were disproportionately impacted by the takeover of Fannie Mae and Freddie Mac — and that were adequately capitalized prior to its failure — were specifically provided for in the bill. Waters is not charged with making that happen; in fact, the Ethics Committee took pains to note that Financial Services Committee Chairman Barney Frank (D-MA) was responsible for that provision.

The Ethics Committee charges, in large part, that Waters failed to tell her staffer, Moore, to refrain from contact with OneUnited after her conversation with Frank and that those contacts enabled OneUnited to receive the capital it needed to stay in business and preserve Waters’ husbands investment. However, the AU investigation notes that OneUnited remains undercapitalized (based on the standard set by the FDIC prior to the receipt of TARP funds) and yet is still in business. Waters has requested a hearing before the Ethics Committee prior to the election in order to clear her name.