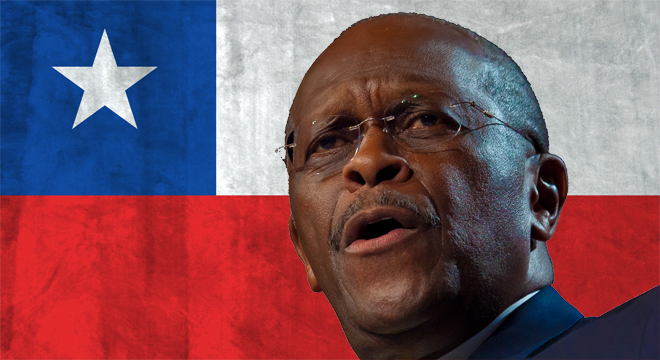

In case you missed Tuesday’s GOP debate, here’s a quick summary: Herman Cain likes talking about his ‘999’ Plan.

He’s also been fond of touting the “Chilean Model” for privatizing Social Security — pitching it as a series of free-market, private savings accounts. But in fact, whether he and his conservative fans realize it or not, Cain is in fact embracing the kind of policy prescription that they have been railing against on certain other subjects throughout this whole campaign.

Progressives might instinctively dislike the ‘Chilean Model’, due to its origins: It was enacted by decree in the early 1980’s, during the military dictatorship of Gen. Augusto Pinochet, to replace a Pay-As-You-Go public pension system (the sort of thing that has Rick Perry calling Social Security a “Ponzi scheme.”). However, this fact alone should not necessarily disqualify it — after all, violent street crime was illegal in Pinochet’s Chile, but that does not mean laws against violent street crime are bad.

But more importantly, Pincohet left office way back in 1990. And after more than 20 years of democracy — nearly all of it under progressive administrations of one stripe or another — the system has simply not been repealed. (However, there have in fact been significant changes, supported across the political spectrum, to increase the government’s role and the coverage for lower-earners — reflecting genuine problems that people have had with the system in practice.)

However, despite the regime that originally imposed it, the overall system has ultimately met with at least some approval from the Chilean people, though it is far from perfect and remains a work in progress. Therefore, the Chilean system does merit at least a close examination on its own merits. But as it turns out, Herman Cain and his fellow Tea Partiers might not like what they find.

A 2008 analysis by the U.S. Social Security Administration lays out the basic idea of Chilean system:

In 1981, Chile implemented its mandatory individual retirement account system allowing workers to choose between the public PAYG and the privately managed system, except those workers eligible to retire within 5 years. Since December 31, 1982, new entrants to the labor force must join the new capitalization system and set up individual accounts with the AFP of their choice. The public PAYG system is being phased out as the number of beneficiaries declines and is expected to close by 2050.

In short, the “Chilean Model” so touted by Cain is the individual mandate. What “Obamneycare” is to health care, Chile’s pensions system is to Social Security, with a system of mandates, regulation and subsidies.

Under the Chilean system, workers must contribute 10% of their income, up to a certain limit — similar to Social Security taxes in this country — to a private pension fund administrator (the different funds are known by the Spanish initials “AFP,” for Administradoras de Fondos de Pensiones).

As a 2001 OECD report makes clear, the Chilean Model actually does involve a significant amount of government regulation on AFP’s, in order to contain risks and ensure stability. From the OECD report:

There are very tight regulations established by law regarding the assets the AFPs can invest in. Safety and profitability are the principles behind these rules. These regulations have taken the form of maximum limits for holdings of particular types of financial instruments as approved by the Risk Classification Commission. This Commission was created in 1985 and its main function is to classify debt securities into several risk categories.

Workers then choose which funds to invest in, according to the different classifications of risk levels. But even then, there is no true free-market risk of total failure and being left out in the cold –Â at least, not for the pensioners.

In fact, the government has maintained a social guarantee of minimum pensions for retirees. Thus, in case of serious underperformance or losses by a fund — or outright bankruptcy of a failing AFP — the government will essentially perform a bailout of retirees, by paying for the difference up to the minimum benefit. Indeed, the reforms that have taken place in the system have been done to address the wide-ranging low payments from the system, with expanded efforts to cover poorer workers and to increase the minimum benefits that the government will provide.

(It should also be noted that the most cautious risk category, Fund E, is composed mostly of fixed-rate instruments such as government bonds — arguably making it a de facto public option.)

Moreover, there is a key wrinkle in the system, which would pose a serious political barrier to its adoption in this country: The transition from the old PAYGO system to the private/mandate model involved removing current workers’ salaries from the old public system, with their former contributions going instead to their private funds. As such, the government has had to absorb the costs of paying retirees who were entitled to any degree of benefits under the old system — and has had to pay for it through higher taxes for the transition.

In short, the Chilean Model — if actually enacted and administered as it is in Chile — would be a far, far cry from the abolition of the welfare state. Instead, it would represent government partnering with private business in order to administer the social welfare guarantees that conservatives are often so quick to denounce. And seriously, how much chance is there of enacting it, if big tax increases were needed in order to provide for current retirees and older workers close to retirement?

A few other Chilean ‘models’ Herman Cain may not be so quick so embrace:

1) Health care in Chile is also covered through the mandate-regulate-subsidize model, in which 7% of workers’ paychecks are deducted in order to pay for health insurance — and with a public option called FONASA (an acronym that could be translated as the “National Health Fund”). Indeed, the majority of workers opt for FONASA, and the government provides subsidies and coverage for poorer Chileans who cannot afford insurance.

2) The current President of Chile, Sebastián Piñera, is a conservative. During the presidential campaign cycle two years ago, Piñera recorded a TV ad that depicted him meeting with supporters from all different walks of life, with the candidate promising to govern on behalf of all the people, and his supporters declaring that he would be their voice. And among those supporters were a gay male couple:

This past August, Piñera proposed a civil unions bill, though it remains to be seen whether the bill can make it through the country’s current Congress.