Reporting from the New Hampshire primary, Fox News’s Carl Cameron observed that Bain Capital was “the venture capital company in which [Romney] both bought and grew companies and occasionally shut a few down.”

But Bain Capital is not, as Cameron said, a venture capital firm. He wasn’t the only reporter to mislabel Bain, either. When Newt Gingrich first ramped up attacks on Romney as a “corporate raider” at Bain, the news media covered the attacks by referring to the company alternately as a venture capital firm and a private equity firm. After a few days, private equity began to be used more often. However, looking over transcripts from Fox News, CNN, and MSNBC, TPM found that all three often continue to use the term “venture capital” to refer to Bain and Romney’s private sector experience.

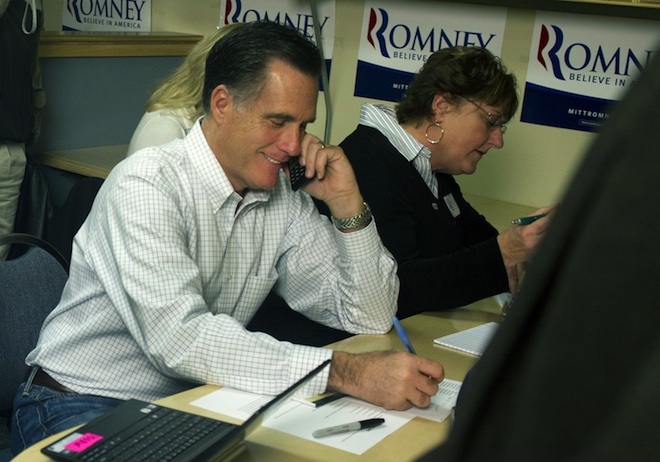

For better or worse, a key feature of this campaign will be Mitt Romney’s record at Bain Capital. As a result, the understanding the difference between private equity and venture capital will help voters understand the man they may vote for in the primary, and possibly the general election. Because venture capital tends to be regarded as a job-creation industry, confusing the two terms will likely work to Romney’s advantage.

The term private equity simply refers to equity that is not public, like stocks. Venture capital — the practice of investing in the early stages of a company — uses nonpublic equity and is therefore a form of private equity. However, most similarities stop there.

“Venture capital and private equity obviously don’t have technical definitions,” said Edward Kleinbard, a law professor at USC’s Gould School of Law and former chief of staff to the Congress’s Joint Committee on Taxation. “But properly used, they point to different business strategies and different points in the life cycle of a business.”

Historically, venture capital is about investing in the early stages of a company in order to help it succeed. With a minority stake in the company, after several years, the venture capital firm will make money by merging the new company or taking it public. If the company doesn’t succeed, they lose their investment.

“Venture capital is all about feeding a toddler of a company; getting it from toddler to early adulthood,” says Kleinbard. Continuing this metaphor, private equity is about improving mature companies.

“Private equity is sort of the successor term to what 20 years ago we called leveraged buyouts,” says Kleinbard. The idea is that the private equity firm buys a company for the purpose of improving profitability and selling the company for a profit. A small percent of the money to buy the firm is raised from investors, but most of it is borrowed. The two pillars of private equity are, says Kleinbard, firstly removing the company from public ownership if they are publicly-traded, and – second – adding a substantial leverage component to the capital structure.

The fact that private equity takes out loans to purchase companies and then puts that debt on the companies’ balance sheets is what earns them criticism. In order to increase profitability, leveraged buyouts — what most private equity firms practice — strip assets from firms, sometimes jobs, in order to make more money. “When you have a ton of debt, particularly high-cost debt, you’re going to try to strip out assets as quickly as possible and extract that value,” says David Min, Associate Director of Financial Markets Policy at the liberal Center for American Progress.

Part of the outrage that Newt Gingrich, and Rick Perry until he dropped out, tried to stir up over Bain was the depiction of a “corporate raider” or “vulture capitalist.” And that is exactly how private equity’s critics see things.

“At its best, [private equity] is taking the weak and flabby and putting them on a diet and exercise regimen,” says Kleinbard. “At it’s worst, it’s just financial engineering: buy it, leverage it, hope the economy carries it and sell it in three years.”

Those more sympathetic see private equity as fixing companies in trouble. “I think private equity is an important institutional development that has enabled troubled companies to come back from the dead,” says Robert Litan, vice president for research and policy at the Kauffman Foundation.

“I don’t think private equity firms typically help businesses at all,” says Joshua Kosman, a finance reporter and author of The Buyout of America: How Private Equity Is Destroying Jobs and Killing the American Economy. Kosman says private equity firms like Bain Capital go for companies with “moderate growth” whose profitability can be increased. If you look at the press releases of the companies Bain bought that eventually went bankrupt, they don’t say these companies are in dire straights, Kosman points out, they say they are profitable companies.

To confuse matters more, Bain Capital does dip its toe into venture capital as well — but it only represents a fraction of the total business. Through a venture capital arm of the company called Bain Capital Ventures, Bain has investments in dozens of companies for a total portfolio of $1.5 billion — accounting for 2.5% of Bain Capital’s $60 billion portfolio, according to Bain’s website (Bain Capital did not respond to requests for comment on the size of Bain Capital Ventures). The Wall Street Journal’s assessment of Bain Capital found that “after its initial focus on small firms needing capital,” Bain “later shifted toward the potentially more lucrative business of leveraged buyouts — acquiring control of businesses by using investors’ money amplified by debt.”

Kosman, who has been researching Bain for years, says that during Mitt Romney’s time at the company, over 90% of dollars spent were on private equity projects, not venture capital.

Even though venture capital is a small piece of what Bain does, Mitt Romney is largely selling his Bain Capital experience to voters as venture capital. That’s because the main success stories Romney touts on the trail — and the source of his claim to have created 100,000 jobs at Staples and Sports Authority — were early venture capital investments. “I’m sure there are examples of people using leveraged buyouts to create jobs,” says Min, “but every finance major in America gets taught about leveraged buyouts as an important way to make money.”

“My personal view is that private equity plays a helpful role to some degree, but the explosion in private equity reflects a real shift in the economy that is fortunate for the very wealthy,” says Min. That’s the last thing Romney wants voters to think.