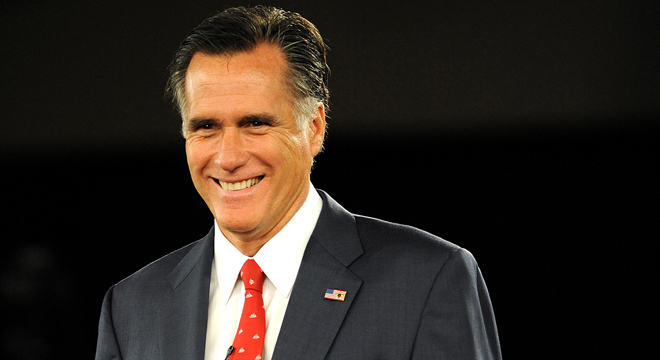

Mitt Romney hasn’t yet released his tax returns, but on Tuesday he confirmed the biggest nugget that Democrats have been salivating over: he pays an effective tax rate of just 15%.

“It’s probably closer to the 15 percent rate than anything,” Romney told reporters, noting that his income “comes overwhelmingly from some investments made in the past, rather than ordinary income or earned annual income.”

He added that he expects to release his tax returns in the spring — although it remains unclear which year of income he’ll actually release.

As TPM has reported, Romney’s admission is hardly unexpected. As he indicated on Tuesday, he’s made most of his fortune, estimated at upwards of $250 million, from investment income, which is taxed at a lower rate than salary. Payroll taxes, which don’t come out of investment income either, are also a major chunk of the average worker’s tax burden. Add it all up and the result is that he pays a lower tax rate than many middle income Americans.

Unfortunately for Romney, President Obama and national Democrats have made fixing this discrepancy a huge component of their economic message heading into the election. They call it the ‘Buffett Rule,” a reference to Warren Buffett’s complaint that the tax code is broken because despite being one of the world’s richest men, he still pays a lower tax rate than his own secretary. The White House is pitching the principle that a reformed tax code should find a way to close the gap.

Democratic strategists have long been giddy at the prospect of making Romney the face of this message. Paul Begala, an adviser to Democratic Super PAC Priorities USA who coined the phrase ‘Romney Rule’ last year to describe Romney’s opposition to raising tax rates for the rich, told TPM on Tuesday that the latest news confirmed that the issue had legs.

“The Romney Rule is going to be a major issue if Romney is the GOP nominee,” he said. “Republicans win the tax debate when the middle class feels they’re paying too much. But Democrats win it when the middle class believes the wealthy are paying too little. It’s bad enough than Mitt made millions by laying off middle class workers. Now he’s making middle class workers shoulder his share of the tax burden.”

Obama campaign spokesman Ben LaBolt also name-checked the Buffett Rule on Twitter Tuesday, noting that President Obama “has called for the loophole that allows the wealthiest to pay lower income taxes than [the middle class] to be closed. Romney opposes.”

So how does Romney’s rate compare to the average American? The recent recession means that the average American’s effective tax rate has been lowered, mostly because the government has instituted a series of temporary tax cuts to help stimulate the economy. In 2010, American households in the middle fifth of the income spectrum, paid an effective tax rate of 14.3%, according to the Center for Budget And Policy and Priorities. So Romney seems to be at about the same spot even though he makes vastly more money.