Critics from both parties are identifying Mitt Romney’s history at Bain Capital as potentially his biggest general election weakness. Now a steady drip of stories threatens to move the issue to the forefront sooner rather than later.

Romney was a founding partner and at one point CEO of the investment firm, where he oversaw the purchase of a number of businesses, many of whom laid off workers under Bain’s oversight.

On Monday, the New York Times revealed that Romney’s retirement package from the company means that he still makes millions of dollars every year off its subsequent dealings. That’s huge news for Democratic oppo researchers, because it puts Romney closer to some of the deals that have been made under his successors’ watch, many of which went through painful restructuring.

For example, Bain’s acquisition of media giant Clear Channel in 2008 has been followed by thousands of layoffs, including many local DJs who were booted without even getting a chance to say goodbye to their listeners.

Making matters worse, Bain’s footprint traverses a number of swing states. It’s one thing for voters in South Carolina and New Hampshire to hear about well-known Bain layoffs in, say, Indiana, but it may be even worse if Democrats run an attack ad about layoffs in their own state.

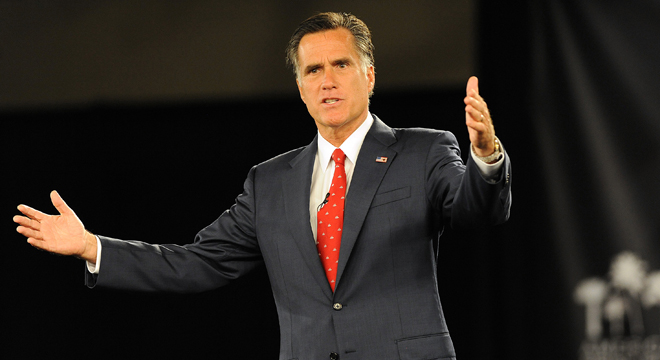

Romney offered one of his most detailed defenses of his time at Bain in the most recent Republican debate in Sioux City, IA, saying he expected to be attacked by President Obama’s campaign over the issue should he become the GOP nominee.

“In the real world that the president has not lived in, I actually think he doesn’t understand that not every business succeeds,” he said, noting that Bain had many highly successful investments to go with its duds, including Staples. “In the real world some things don’t make it. I believe I learned from the successes and the failures.”

But the toughest part may be explaining some of the cases where the businesses failed, but Bain still managed to turn a profit through management fees and dividends. And Democrats have indicated that they plan to zero in on this particular angle.

“That’s where his storyline collapses,” Priorities USA advisor Paul Begala told the Washington Post’s Greg Sargent on Monday. “It doesn’t sit right to see companies go bankrupt and go through layoffs, and watch the layoff artist walk away with millions of dollars.”