As I’ve argued, I don’t think we should care that much about whether Elon Musk purchases Twitter. Having a mercurial scofflaw purchase the company should simply remind us that it’s a private company, not the 21st-century public square or anything like it. Social media companies have a deep interest in convincing us of these things and then luring the public into a faux corporatized speech jurisprudence in which they of course are always in charge. So while it seems increasingly unlikely that Musk’s purchase of Twitter will go through, let it burn is probably the best policy response. But as Musk has been all over the news and increasingly associating himself with the far-right, I’ve been increasingly interested in his main company, Tesla.

I had never given much thought to the company. My only real exposure to its products is that a family member owns a Tesla. I’ve been driven in it a few times and it seemed pretty cool. I also knew about the sky-high stock valuation, higher than all the other major auto manufacturers combined. What I didn’t know until I started poking around recently is just how stratospheric the company’s stock run up was over a period of barely two years.

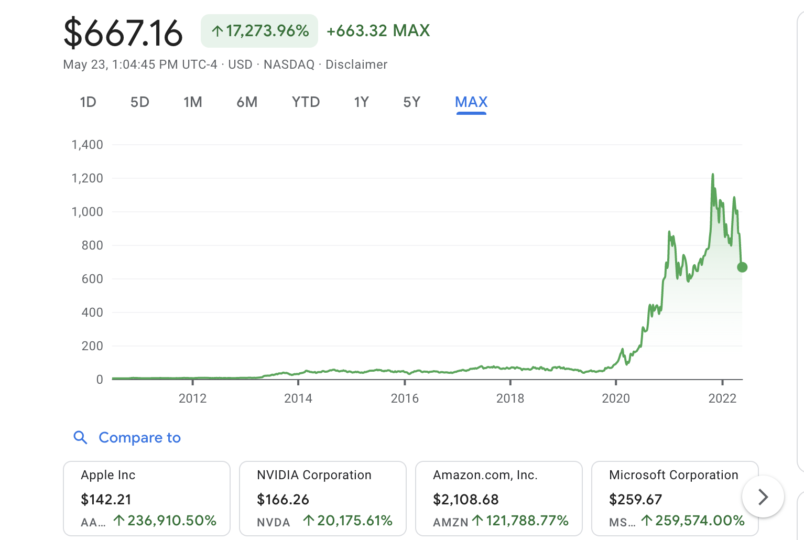

From 2014 until just before the beginning of the pandemic, Tesla’s stock had ranged around $50 per share. Under and over but in that general ballpark. Then in the late fall of 2019 it started a rapid ascent that peaked at just over $1,200 two years later in late 2021. In other words, more or less during the pandemic the value of the company went up more than 20 fold.

What could possibly justify that?

Well, there are some things that could. Clearly electric cars are the future. And Tesla got in early. The critical thing is that around this period Tesla made some key moves that brought it from great potential to something more than potential: actually producing and selling a lot of electric cars at scale. That’s a big deal. What’s more, Tesla isn’t only a company involved in electric cars. It’s also a big player in energy storage, which for all the fossil fuel transition reasons is also a critical part of the economy of the future. Tesla’s involved in batteries. It’s involved in solar panels. It’s involved in the batteries you would use in your house in conjunction with those solar panels.

What all of this means is that there are technologies Tesla is deep into which are critical for electric cars but have applications far beyond cars. All of that suggests potential still far beyond the still relatively small number of cars it produces.

By now I’m probably starting to sound like a Tesla booster or fanboy. I’m not. But I note this to make clear there are some very sound reasons why the company’s value has gone up dramatically over the last two or three years. But there’s dramatic and there’s dramatic. A 20-fold run up in value is so totally bonkers that it’s very hard to see how the company’s fundamentals are even close to meriting that.

What else is driving it? Well, there are some changes specific to equity markets that have fueled the company’s rise. It’s become a good place to park funds earmarked for “green” investing. Also, in December 2020 Tesla joined the S&P 500. That made it a purchase for many index funds. Those have both helped buoy the stock.

But there’s more.

Tesla’s run up in value has been heavily driven by individual investors. And beyond that it’s been driven by a whole ecosystem of derivatives and financial instruments based on Tesla’s stock. This is sometimes called the “Tesla Financial Complex” or the “Tesla derivatives ecosystem.” I’m not even going to try to explain precisely how that works. You can read about it here.

Another factor is Musk’s own social media presence and the Musk cult which is wildly powerful on various social media platforms but especially on Twitter. And then there’s bots. There is a small cottage industry of researchers who have demonstrated that an army of bot accounts on Twitter have played a pivotal role in building up the cult of Tesla and the cult of Musk, and thus playing a key role in driving up the company’s stock price. That in turn has provided a lot of the fuel driving the popularity of Tesla and Musk among individual investors.

Who’s running these bots? Who knows.

Here is where I should draw back and tell you what I hope is obvious: nothing I’m saying here is remotely new or anything I’ve discovered. I’m just dipping into conversations that have been going on for years in the tech, automative and financial industry press. Many of you are probably totally familiar with what I’ve described above. It’s just that I wasn’t aware of it. Or I wasn’t aware of the sheer scale and speed of the run up that isn’t really explained by the performance or even potential of the company or what seems like a bubble-creating apparatus which has been built up around it.

That all seems more interesting and relevant because as the richest man in the world he appears increasingly focused on leveraging his wealth into political and informational power. Just this last weekend he flew to Brazil to meet with the country’s floundering, fascist-curious President, Jair Bolsonaro.

When Musk announced his plans to purchase Twitter and leaned into his current romance with the far right, I was continually struck by a simple irony: unlike so many other “fake it till you make it” tech stars whose companies are driven by network-effects razzmatazz and hype, Musk’s companies really make things that people use. The cars run and people seem to like them. The rockets take off and actually land. For all the viral videos you see about Tesla cars catching fire, these points are clearly true. But the more I learned about Tesla and thus Musk’s fortune and current globe-bestriding power, Tesla started to seem less like an auto manufacturer and more like a particularly high-flying meme stock.

So many of the details here are beyond my knowledge or expertise that I’ve intentionally kept much of this general. How much of the run up of Tesla’s stock was bubble and how much was real? The stock price has fallen almost 40% since late March. Is it now down to a reasonable price? No idea on any of these fronts. But given the vast power and wealth Musk wields, I wanted you to have some general awareness of the basis of Musk’s wealth and the questions about it.