On Wednesday night all the news hole-driven stories about debate expectations will give way to real evaluations of the candidates’ performances and the accuracy of their statements.

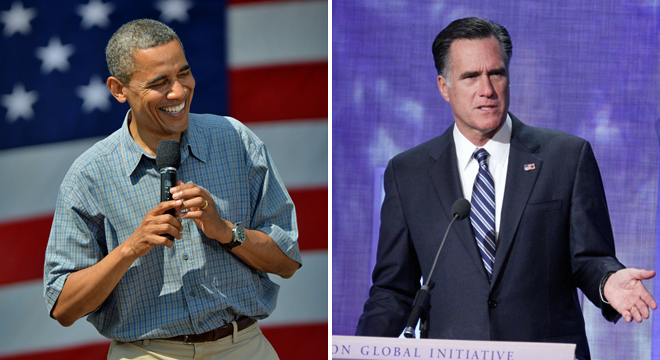

While moderators and candidates tend to dwell on subjective or superficial questions — about the tone of the race, or the candidates’ personal evaluations of each other — Wednesday’s domestic policy debate will allow Mitt Romney and Barack Obama to confront each other directly over some of the most pressing substantive issues of the campaign.

Here’s what we’ll be looking for.

Health Care

During the primaries, Romney would often boast that he’s strongly positioned to undercut Obama’s best defense of the Affordable Care Act. If Obamacare really is modeled after Romney’s own Massachusetts health care law, why didn’t Obama call Romney during the legislative process for help designing it. Here, the facts are on Obama’s side. Most succinctly, MIT professor Jonathan Gruber, who provided both Obama and Romney health care reform advice, called Obamacare and Romneycare “the same f***ing bill.”

Medicare and Medicaid

Relatedly, the Romney camp’s plans for Medicare and Medicaid — but particularly for Medicare — have become central liabilities for them over the past several weeks. Specifically, they propose to cut funding to Medicaid dramatically and hand management of the program to individual states, and to provide seniors vouchers to buy either private health insurance or access to traditional Medicare. They’ve tried to neutralize the issue by attacking Obama for cutting Medicare spending by over $700 billion for current seniors. Those cuts — part of the ACA — come from ending overpayments to hospitals and private insurers, and restoring that spending to Medicare would render the program insolvent by 2016.

Welfare

Obama thinks the debate will be an ideal venue to call Romney out for a claim widely disputed by journalists and independent fact checkers: that Obama “gutted” the 1996 welfare reform. The Obama administration has proposed allowing states more flexibility to move people from welfare to work if they can demonstrate an ability to do so with greater efficiency. Romney and his campaign have falsely construed this as ending the welfare to work requirement. “It will be a little tougher [for him] to defend face-to-face,” Obama said recently. Ironically a bunch of House Republicans did in fact vote to end welfare to work requirements as part of an effort to further roll back the welfare program.

Taxes

Perhaps sensing an opening for Obama, Mitt Romney offered up a new tax reform idea Tuesday afternoon — capping individuals’ tax expenditure benefits at $17,000 a year. That would presumably come on top of — and offset revenue losses from — his plan to cut everyone’s tax rates by 20 percent. Only problem? That still wouldn’t be revenue neutral. And to make his plan fully revenue neutral, he’d likely have to raise effective tax rates on middle income people. Obamas plan would allow the Bush tax cuts for top earners to expire, and cap deductions on high income.

Tax Returns

A companion piece to Obama’s attacks on Romney’s tax plan is the fact that Romney himself has paid a very low effective tax rate the past two years — and that he refuses to release tax returns for any year before 2010. Romney recently dispelled one of the nastiest pieces of Democratic speculation about his taxes — that he paid no taxes for 10 years. But what he’s already revealed, and the fact that he refuses to release more information, leaves him vulnerable in the debate to questions about transparency and the unorthodox wealth management strategies he’s used to build his fortune.

47 Percent

Romney’s unearthed remarks attacking the 47 percent of people who pay no federal income tax was the most defining and revealing moment of the campaign. We expect it to get extensive treatment Wednesday night. Romney and his campaign have attempted to walk the remarks back, or at least soften the impact they’ve had. But Obama has capitalized on the remarks in ads and public comments. But this is a long-standing conservative bugaboo. And the substantive implications of wanting everyone to pay federal income taxes are ugly and politically damaging.