Senior White House officials tonight put a positive spin on the tax cut framework President Obama has agreed to with the GOP, while insisting, repeatedly, that they oppose — and will only reluctantly swallow — a two year extension of the Bush tax cuts. But the tentative deal is now subject to the consideration of Congressional Democrats who have already telegraphed serious concerns with the plan.

On a conference call with reporters, administration officials boasted of securing nearly $200 billion in new stimulus measures — a one-year, two-percent payroll tax cut, and a year-long extension of unemployment insurance — in exchange for giving the wealthiest Americans two further years of tax cuts. But though this framework will punt the tax cut fight into the 2012 elections, frightening a number of Congressional Democrats, the officials insist that they will not shy away from the fight as election season heats up.

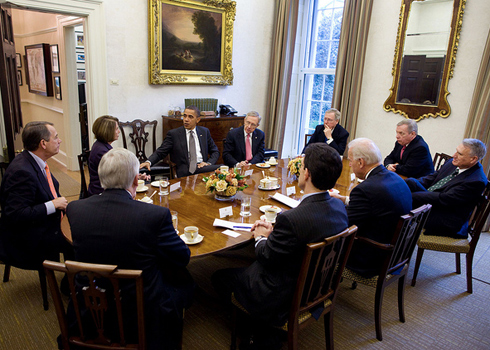

Addressing the media tonight, President Obama outlined the compromise.

“In exchange for a temporary extension of tax cuts for the wealthiest Americans, we will be able to protect key tax cuts for working families, the Earned Income Tax Credit, that helps families climb out of poverty, the child tax credit that makes sure families do not see their taxes jump up to $1,000 for every child, and the American opportunity tax credit that insurers over eight million students and their families won’t their costs of college shooting up,” he said.

These are the tax cuts for those that have been hit hardest by this recession. It would be unacceptable if their taxes went up while everybody else’s went down. We are facing the prospect of having this lifeline yanked away from them in the middle of the holiday season. This would mean a 2% employee payroll tax cut for workers next year. The tax cut that economists agree is the most powerful thing we can do to create jobs and boost economic growth.

Additionally, the White House secured a 13 month extension of unemployment insurance back-dated to December 1; a one-year, two percent employee payroll tax reduction; and tax write-offs for businesses building their capacity.

Officials estimated the between the payroll cut ($120 billion) and the unemployment extension ($56 billion), the administration will net at least $176 in stimulative activity.

The unemployment extension has the higher multiplier, but the two percent cut will reduce employee-side payroll taxes from 6.2 to 4.2 percent. According to officials, “a worker making $70,000 would get $1,400 in tax relief.”

“The payroll tax cut has been shown to be one of the higher impact tax cuts for encouraging job growth and economic growth,” a senior aide said. “It may not have as high a multiplier as UI but among tax cuts its one of the strongest.”

That doesn’t mean it’s a done deal. The plan has thus far received an icy reception from Capitol Hill Democrats. In a one-sentence statement to reporters, Jim Manley, spokesman for Senate Majority Leader Harry Reid said, “”Now that the President has outlined his proposal, Senator Reid plans on discussing it with his caucus tomorrow.”

Sen. Bernie Sanders (I-VT) claims he will join a filibuster of the plan if and when it hits the Senate floor.

And Senate Minority Leader Mitch McConnell says he’s “optimistic that Democrats in Congress will show the same openness to preventing tax hikes the administration has already shown,” though he’s received no assurances.

Progressive economists have worried that a payroll tax break along the lines of the one announced tonight could come back to bite Democrats if it undermined the solvency of Social Security. But officials tonight insisted that its cost to the Social Security trust fund will be reimbursed with a credit from general revenue.