The revelation that banking giant JP Morgan lost $2 billion making risky bets with depositor funds is only four days old, but early indications suggest that the financial industry’s capture of American government successfully weathered the 2008 crisis, with nearly all the political and regulatory players invested in the consequences of this latest debacle treading lightly around the questions it raises.

It has, however, re-energized outside advocates of strengthening financial reform — including a certain high-profile Senate candidate — and left those who favor repealing the 2010 Dodd-Frank Wall Street reform law in an untenable position.

Likely GOP presidential nominee Mitt Romney has been silent about the loss. His campaign issued a Friday statement giving JPM the benefit of the doubt that its trades were designed to insure against risk rather than speculate for profit.

“JP Morgan’s reported $2 billion trading loss demonstrates the importance of oversight and transparency in the derivatives market, something Gov. Romney has called for in the past,” said Romney campaign spokesperson Andrea Saul. “JP Morgan’s investors, not taxpayers, will incur any losses from this hedging trade gone bad. As President, Gov. Romney will push for common-sense regulation that gives regulators tools to do their jobs, and that gives investors more clarity.”

The Obama camp, and President Obama himself, have done better — but have largely seized on the development to criticize Romney for seeking to repeal Obama’s reform law. In a commencement address Monday at Barnard College in New York, Obama alluded to the news without naming the responsible party, or his opponent. “We know that we’re better off when there are rules that stop big banks from making bad bets with other people’s money,” he said. In a Friday statement to TPM, an Obama campaign spokesperson elaborated on the same view.

When he did address the JPM fiasco directly, in a pre-taped interview with ABC’s The View set to air Tuesday morning, Obama made sure to preface his view that it vindicates his own banking reforms with praise for JP Morgan CEO Jamie Dimon and his firm.

“JPMorgan is one of the best managed banks there is,” Obama said. “Jamie Dimon, the head of it, is one of the smartest bankers we got and they still lost $2 billion and counting,” the president said. “We don’t know all the details. It’s going to be investigated but this is why we passed Wall Street reform…. Now we’re still fighting this battle because all these regulations are being put in place as we speak, a lot of the financial industry is still fighting, they have hired tons of lobbyists to push back on this stuff and I hope that everyone who is watching is letting their members of congress know, you know what we want these rules in place to make sure this stuff does not happen again. ”

Several members of Congress, including the authors of the so-called “Volcker Rule” — the forthcoming regulations intended to prevent the sort of trading JPM engaged in — have criticized the firm, Dimon, and the regulators who wrote big loopholes into the draft of the regs themselves. Some have called for direct hearings. Several regulators have announced they will conduct inquiries.

But the Volcker Rule, as drafted, may not actually achieve it’s intended aim, and may not have been tightly drawn enough to prohibit the trades that allowed JP Morgan to make its big gamble. According to Sen. Bob Corker (R-TN) a prominent Republican on the Senate Banking Committee, JPM’s regulator (the Office of the Comptroller of the Currency, also reviewing the loss) doesn’t believe the firm’s trades would have violated the Volcker Rule if it were in effect as drafted.

“That’s just absolutely not their perspective,” Corker said in an appearance on CNBC Monday.

In a statement Monday, OCC said it was premature to draw any conclusions about Volcker Rule implications. “The transactions at issue are complex and whether they would qualify for exceptions under the statute or proposed rule requires careful analysis.”

Still, Corker argued that the JPM development was significant enough to move the needle on financial reform — in other words, the Volcker rule could be strengthened.

“Policies are going to be derived out of what’s happened,” he said. “I mean something this high profile with somebody who’s such a spokesman for the financial industry, there will be outcomes here.”

If he’s right, the first place we’re likely to see evidence of that is in a series of forthcoming hearings with financial industry regulators before Corker’s committee.

“These hearings will provide Banking Committee members the opportunity to hear from and question witnesses from the SEC and CFTC on derivatives oversight and the Federal Reserve, FDIC, CFPB, and OCC as well as the Treasury Department on enhanced bank supervision,” said Chairman Tim Johnson (D-SD) in a statement. “Other issues related to financial stability expected to be discussed at these hearings include the recently reported $2 billion trading loss by JPMorgan Chase, proposals to reform money market funds, and the economic situation in Europe.”

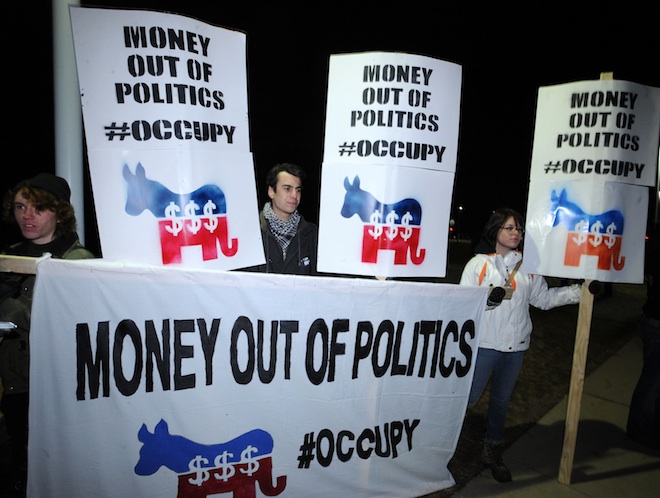

But there’s often a wide chasm between congressional preening and legislative or administrative action. And in the meantime, the forces pushing most aggressively for action are outside the Senate.

Elizabeth Warren — a career Wall Street reformer, architect of the Consumer Financial Protection Bureau, and Democratic Senate candidate challenging Sen. Scott Brown (R-MA) — has called for Dimon to resign from the board of the New York Federal Reserve; for Brown to disclose his fundraising ties to Wall Street; and for the reinstitution of so-called Glass-Steagall protections which for decades prevented federally backstopped commercial banks from owning hedge funds or other risky investment firms. Those restrictions were weakened over the years, and repealed entirely in 1999.

Brown played a key role in weakening Dodd-Frank — and the Volcker Rule in particular — as the 60th vote for breaking the GOP filibuster of the bill. His campaign has so far not commented on Warren’s call for Dimon’s Fed board resignation, and has declined to disclose the members of his New York Finance Committee.