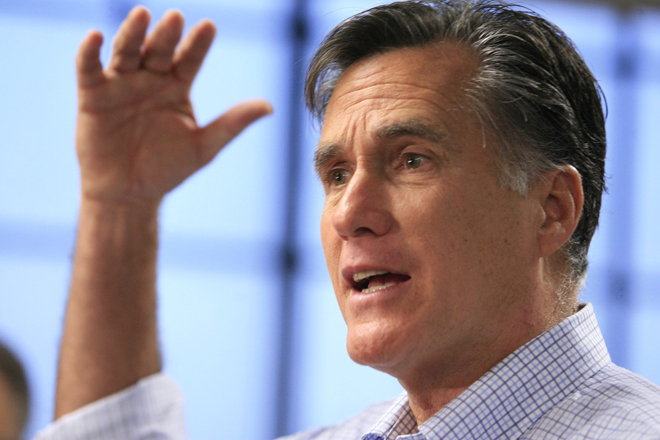

Mitt Romney’s big new tax reform idea — to cap the amount individuals can benefit from tax deductions in a given year — still lacks for hard specifics but the basic shape of the idea provides tax economists key clues about its potential incidence. And the biggest loser, if he were to implement the plan as president, according to an expert on charitable giving, would be one of the right’s favorite features of the tax code: the deduction for charitable giving.

“The effect on charitable giving is likely to be large for high income individuals, especially in the short run,” says Jim Andreoni, a UC San Diego professor of economics who studies the economics of charitable giving.

Under the current tax code, people are allowed to deduct scores of expenses from their taxable income. Mortgage interest is tax deductible. The cost to workers of their employer-provided insurance is excluded from their taxable income. And reflecting the long-held conservative view that private giving rather than government should be the main source of public welfare, charitable contributions are partially exempt from taxation.

If Romney were to impose a cap on the total amount individuals could benefit from these deduction, people would likely respond by shifting priorities, experts say. But some priorities are more easily shifted than others. While it’s very difficult to downsize a home, and a bitter pill to accept stingier health insurance benefits, cutting smaller checks to churches, universities, and ballet companies is a no-brainer.

“Some deductions are difficult to change, like mortgage interest or property taxes,” says Andreoni. “Those will stay fixed for now, and for many high earners will more than use up the $17,000 cap on deductions. By contrast, charitable giving is about the only category of deduction that people can use in the short run to adjust for an increase in taxes. … [E]ven though both your mortgage and your charitable giving are losing some tax benefits, only your giving can change in the short run to make up part of that loss.”

That’s likely to have an enormous impact on charitable giving from people who hit the cap.

“[D]ata show that the tax deduction is very important to donations,” Andreoni adds. “So, high income donors will have two reasons to cut back on giving. First, they are losing after-tax income from deductions on things other than giving and that are hard to adjust, like mortgage interest. Second, giving itself will become far more expensive and is far easier to change than other deductions. It’s intuitive to me that charitable giving will take a big hit from the cap on deductions.”

Romney initially floated the idea of capping deductions $17,000 per year — though he was unclear whether he was referring to overall tax benefit or the actual value of the deductions themselves. To underscore just how new and unfixed his plan is, he tweaked it during Wednesday night’s debate. “One way, for instance, would be to have a single number. Make up a number — $25,000, $50,000. Anybody can have deductions up to that amount. And then that number disappears for high-income people.”

In either scenario, high-income individuals will be most affected. And, thus, the charities that top earners value most will take the biggest financial hit. That’s probably okay news for churches, but bad news for culture and education.

“[H]igh income people are most likely to support higher education, health/hospitals, and the arts. Low and middle income people give mostly to religious,” Andreoni said. “To put it another way, higher ed, health, and the arts are going to suffer more than religious organizations, simply because of who composes their donor base.”