Reporters and policy makers have for months used the term “fiscal cliff” as shorthand for the myriad expiring tax provisions and automatic spending cuts scheduled to take effect early next year.

The implication is that either the budget will consolidate — in some cases messily — and the economy will contract, or Congress will reach an agreement to push back the deadlines for action.

But economists at the liberal Economic Policy Institute see things a bit differently. They’ve broken the expiring and automatic provisions up into their constituent parts, creating what they call a “fiscal obstacle course.” And they’ve concluded that some of those obstacles, including the middle-income tax cuts, are worth tripping over.

“[T]here is no good economic reason to extend the upper-income Bush-era tax cuts or the recently expanded estate and gift tax cuts; they fail any reasonable cost-benefit analysis for economic stimulus,” write EPI’s Josh Bivens and Andrew Fieldhouse, in echoing the consensus Democratic Party position. “Allowing them to expire would shave a meager 0.1 percentage point from real GDP growth in 2013 relative to current policy, but revenue would rise by $1.2 trillion (0.6 percent of GDP) over fiscal 2013-2022.”

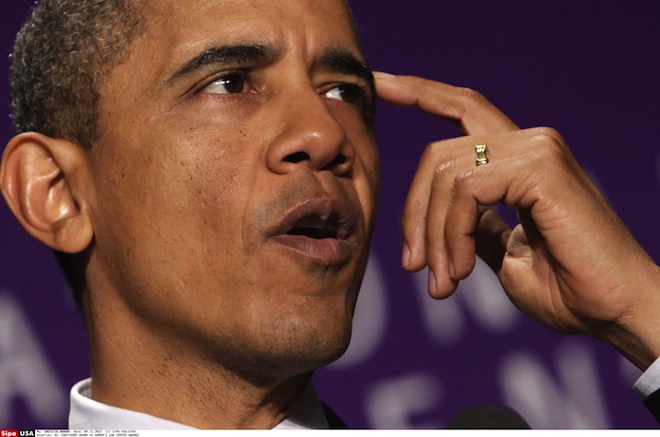

But Bivens and Fieldhouse take things a step farther, contradicting one of President Obama’s key goals this election — to extend Bush tax cuts for everyone’s first $200,000 in income.

“The case for extending the middle-income Bush tax cuts is also thin, and expiration would increase revenue by another $1.4 trillion (0.7 percent of GDP) relative to current policy over fiscal 2013-2022,” they argue.

But the idea isn’t to increase taxes across the board exclusively for the purposes of reducing the deficit.

Bivens and Fieldhouse contend that much of that money, as well as money from the expiring payroll tax cut — be applied to temporary stimulus programs such as state aid and enhanced unemployment benefits. Simultaneously, they argue that Congress should avoid the automatic spending cuts in the sequester, and lift the cap on discretionary spending to avoid particularly harmful fiscal and economic contraction.

Republicans and Democrats have both concluded that the election will largely determine how Congress handles the fiscal cliff — or fiscal obstacle course. But Republicans remain overwhelmingly opposed to allowing the top bracket Bush tax cuts to expire alone. And many political vets believe that all the Bush tax cuts will have to expire, at least temporarily, if Obama wins re-election.

That would give President Obama leverage to work with Republicans on a broader package of spending cuts and tax cuts. The EPI report suggests near-term stimulus should be a part of the mix.