In the wee hours of Friday morning, along party lines, House and Senate negotiators settled on the final shape of legislation meant to rein in Wall Street. The deliberations were tense at times, with House members forced to accept many of the Senate’s positions, and legislators with close ties to Wall Street at loggerheads with progressives seeking to make the bill as restrictive as possible.

In the end, they fought to a draw.

Wall Street won a number of battles, but broadly speaking the conference committee strengthened the legislation in some ways, weakened it in others, and for the most part the final bill pretty closely resembles the legislation that passed the Senate this spring.

Big banks won one big fight yesterday, which will allow banks to continue investing a significant amount of equity in hedge funds. But that was in the context of a greater battle over whether banks should be allowed to make speculative trades with their capital…and they lost that one.

The more dramatic tussle was over a provision, authored by Sen. Blanche Lincoln (D-AR), meant to force big financial firms to spin off their derivative trading desks into separate affiliates that do not enjoy federal protections. The haggling over that provision dragged on past midnight. Wall Street largely lost, having pushed hard for months to get it scrapped entirely. However, big firms will retain the ability to trade derivatives in house for the purposes of hedging their own risk.

That doesn’t mean Wall Street walked away without anything to show for the fight. In the previous days, for instance, it succeeded in gutting an amendment meant to eliminate conflicts of interest at credit rating agencies. That measure would have prevented big firms from shopping around between agencies in search of the best rating. Now it will first be subject to a two year review before implementation and could be scrapped altogether. Similarly, industry won a number of exemptions from new consumer protection and trading regulations.

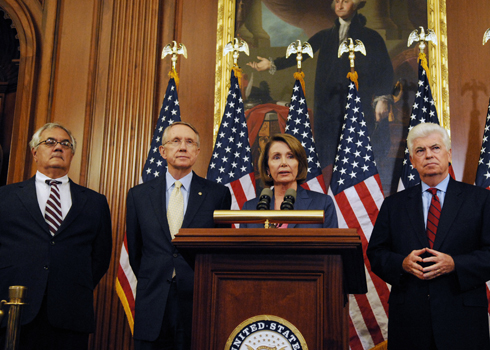

“I am proud of this bill, and I am proud of the open and transparent process that led to such a successful result,” said Senate Banking Committee Chairman Chris Dodd, who lead negotiations for the Senate.

Now the legislation goes back to each chamber for a final vote. Bank-friendly House Dems will have to support the bill for it to pass. In the Senate it will likely be held to a 60-vote threshold. With two Democrats continuing to oppose the bill from the left, Dodd and Majority Leader Harry Reid will have to woo the same Republicans who supported the bill the first time around, with little to no margin for error.