Seeking to neutralize the Obama campaign’s charge that his tax proposal will disproportionately benefit the wealthy, Mitt Romney has subtly changed the way he talks about his plan, in a way that obscures what its impact would be.

Before the general election, Romney consistently argued that he wanted the wealthy to pay the same share of the overall tax burden as they do today. Now, as often as not, he claims he doesn’t want to reduce their burden at all.

The two descriptions of his plan have wildly different implications — and he’s effectively using their superficial similarities to hide the real impact his proposal would likely have.

Romney’s official proposal is to cut all marginal rates by 20 percent and to eliminate unspecified tax loopholes for high incomes. When nonpartisan experts analyzed the plan they concluded that under friendly assumptions his rate cuts will either require a higher burden on the middle class or an increase in the deficit.

That conclusion caught Romney’s campaign flatfooted — and so he changed the pitch. Now he promises that the middle class will see a reduced tax burden, the rich will pay the same amount, and the deficit won’t rise. But that describes an entirely new tax reform proposal — one which experts also say would increase the deficit.

Yet despite this major change, Romney has been able to avoid direct scrutiny about it from the media, even as he bounces back and forth between insisting that high income earners as a group will continue to pay the same share of the taxes as they do now and asserting that individual high earners will pay the same proportion of income as they do now.

During an appearance on CNN Tuesday, Romney offered both descriptions of his plan at separate points in the interview with Wolf Blitzer. First, Romney said his plan would not “reduce the burden on high-income taxpayers.” He later added, “I want high income people to continue to pay the same share they do today.”

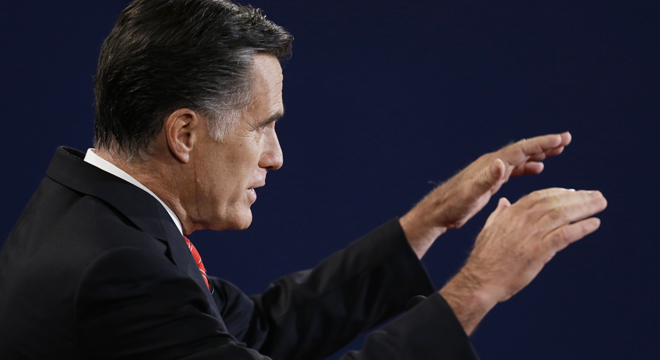

Last week during the first presidential debate Romney also described it both ways. At one point he said, “I’m not going to reduce the share of taxes paid by high- income people.” But at another point he emphasized, “I will not reduce the taxes paid by high-income Americans.”

A month ago on NBC’s “Meet The Press,” Romney said, “I want to make sure people understand, despite what the Democrats said at their convention, I am not reducing taxes on high-income taxpayers.”

On Tuesday, he told the Des Moines Register, “I start off with a very fundamental principle, which is we want to reduce the burden on middle-income taxpayers, and we’re not going to provide a tax break to high-income taxpayers.”

All four interviews yielded credulous media reports echoing — with little or no skepticism — Romney’s vow that he won’t cut taxes for the rich, and that his goals are achievable. His campaign has hedged at times — either suggesting Romney won’t cut rates as much as he wants to if the numbers don’t add up, or floating a deduction cap — but walked back each of those ideas and insisted his math is sound.

Romney’s spokesperson didn’t return a request for comment on this article. He and his running mate Paul Ryan have repeatedly refused to specify any tax deductions or loopholes they would consider eliminating to cover the cost of their plan. Many of those loopholes, such as perks for oil companies and corporate jets, have strong support among Republicans in Congress.

The nonpartisan Tax Policy Center, which Romney himself cited this week, found that eliminating every last tax deduction and loophole for incomes above $200,000 still won’t cover the cost of the $5 trillion in tax cuts he has proposed. TPC’s William Gale, an author of the study, reaffirmed the conclusion on Tuesday and lamented that much of the political media has helped obscure reality by going along with Romney for the ride.

“Romney can’t do all of the tax cut proposals he has advocated, remain revenue neutral, and avoid taxing households with income below $200,000 or cutting taxes for higher income households,” he wrote. “Most obviously, despite all of the hoopla and name-calling, no one has proved or really even tried to prove that the analysts’ original calculation was wrong.”

“[T]he basic power of arithmetic is overwhelming in showing that Governor Romney has so far overpromised on the tax side. … You still can’t drive cross country in 15 hours without speeding.”