In repeatedly denying during Wednesday’s night debate that his proposed 20 percent across-the-board tax cut would cut government revenues by $5 trillion over 10 years, Mitt Romney stopped short of providing his own figure for how much the proposal would cost the Treasury.

Asked by TPM what the accurate cost of Romney’s tax rate cuts would be, Romney spokeswoman Andrea Saul dodged: “His tax reform proposal is revenue-neutral,” she said.

So it has gone throughout the campaign. Neither Romney nor his campaign nor his economic advisers have ever specified the cost in lost revenue of his sweeping tax cut proposal.

Instead they have insisted that he can bring down all income tax rates by 20 percent without adding to the deficit, largely by scaling back deductions and credits for high-income earners. But he and his campaign have refused to specify a single tax loophole he would target in order to offset the cost of the tax cuts.

Wednesday’s debate brought into clearer focus that Romney is dodging specifics on the cost of the tax cut itself, too.

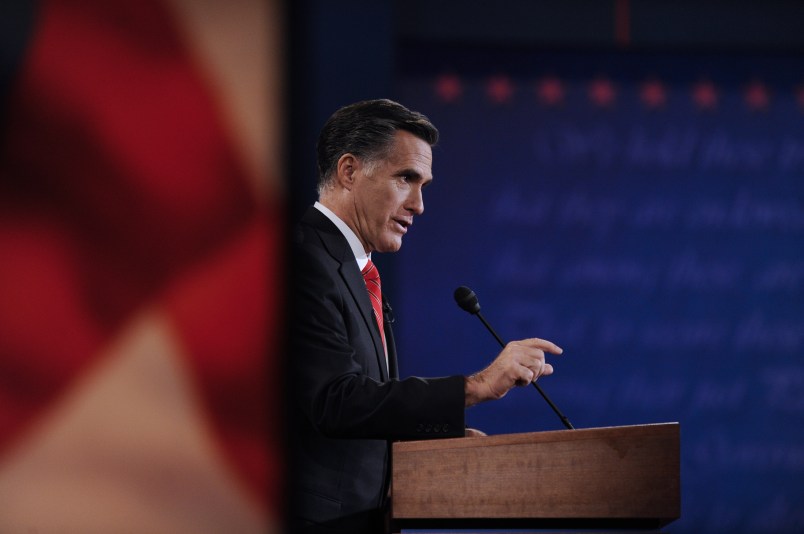

“First of all, I don’t have a $5 trillion tax cut,” he said. “I don’t have a tax cut of a scale that you’re talking about. My view is that we ought to provide tax relief to people in the middle class. … Look, I’m not looking to cut massive taxes and to reduce the revenues going to the government. My number one principle is there’ll be no tax cut that adds to the deficit. So any language to the contrary is simply not accurate.”

But the $5 trillion figure isn’t one made up by the Obama campaign. It was reached independently by outside experts, most notably the nonpartisan Tax Policy Center. That figure is also the basis for assessing which and how many of the tax code’s deductions and credits Romney would need to eliminate in order to make up for the revenue shortfall his tax rate cuts would create. TPC, for example, found that even if Romney eliminates every penny in tax deductions for incomes above $200,000 his proposal would still increase the deficit.

Here’s how the Tax Policy Center broke down the numbers: Romney’s tax cuts would cost $251 billion per year (as of 2015), and all the available loopholes that can be closed for incomes above $200,000 total $165 billion. That leaves $86 billion unaccounted for annually — an estimated $860 billion increase in the debt over 10 years.

Romney’s insistence that the plan adds up — even as his advisers have admitted that it may not — contradicts even the friendliest analyses of his blueprint. A report by Harvard economist and Romney adviser Martin Feldstein found, using highly optimistic assumptions, that taxes would need to go up on Americans earning between $100,000 and $200,000 in order for his reform plan to be revenue-neutral.

When Obama pointed out that the middle class would bear the costs, Romney all but disavowed his own plan. “Virtually everything he just said about my tax plan is inaccurate,” he said. “So if the tax plan he described were a tax plan I was asked to support, I’d say absolutely not.”

The Obama campaign has already made Romney’s denial of the $5 trillion figure a centerpiece of its post-debate message. “It could not have been Mitt Romney because the real Mitt Romney has been running around the country for the last year promising $5 trillion in tax cuts that favor the wealthy,” Obama said on the trail Thursday. “The fellow on stage last night said he did not know anything about that.”