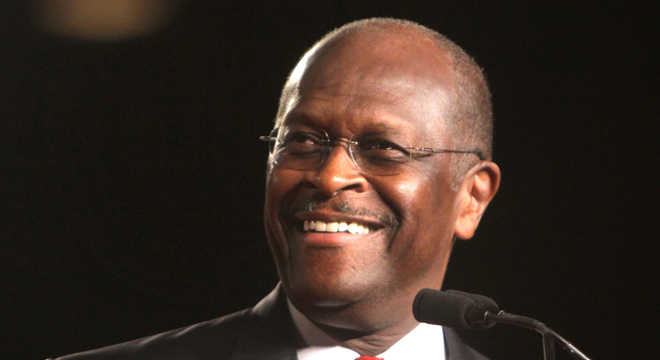

As Herman Cain has climbed in the polls, lawmakers and other GOP presidential candidates have had to contend more seriously with his ideas. One of the main attacks his opponents have leveled against his 9-9-9 tax plan is that it won’t fly in Congress.

True story. Today’s GOP leaders aren’t willing to embrace the plan, which would wipe out the current tax code and replace it with a nine percent tax on individual income, a nine percent tax on corporate income, and a nine percent sales tax.

As noted here, here, and here, the plan has a lot of problems. It’s deeply regressive. As businesses passed on the cost of their share of the tax to consumers, it would hit low and middle income earners exceptionally hard at a time when the economy desperately needs more, not less, consumption. And part of it’s probably unconstitutional, at least as Cain envisions it.

But it also scares conservative anti-tax advocates who worry it contains the seeds for higher revenues in the future. And so congressional Republicans would rather keep their eyes on the prize.

“All the presidential plans are out talking about what they’d like to do,” Senate Minority Leader Mitch McConnell (R-KY) told reporters at his weekly Tuesday press briefing when asked about the plan. “What we’re dealing with is what we were to do. And right now I think there is bipartisan agreement among Democrats and Republicans that tax reform would be a good thing for the country….I think we’re ready on a bipartisan basis here in Congress to take that up.”

McConnell says Congress won’t be pursuing 9-9-9 or anything like it. Instead they’ll pursue tax reform the same way Congress has in the past — by cleaning up the existing code and lowering marginal rates.

“When President Reagan came to office the top rate was 70 percent, when he left it was 28 percent,” McConnell said. “Regretfully in subsequent years, the rates went back up, big preferences came back in and its time to do that again. The presidential campaign is one thing. We’re pursuing out own interests here.”

Sen. John Thune (R-SD), the fourth ranking Republican in the Senate, doesn’t want to get bogged down in it either.

“It’s got an element of simplicity to it which I think is attractive to the American people but as is always the case, the devil’s in the details and you have to sit down and do the math and figure out does it add up,” Thune cautioned. “And I think that’s what people are doing right now…. I think in terms of our efforts to reform the tax code here, my guess is that wouldn’t be the starting point, but we’re going to be looking for opportunities to reform the tax code and making it simpler is certainly one of the goals. As I said, if we don’t start with 999, we’ll start someplace.”

Brian Fung contributed reporting.