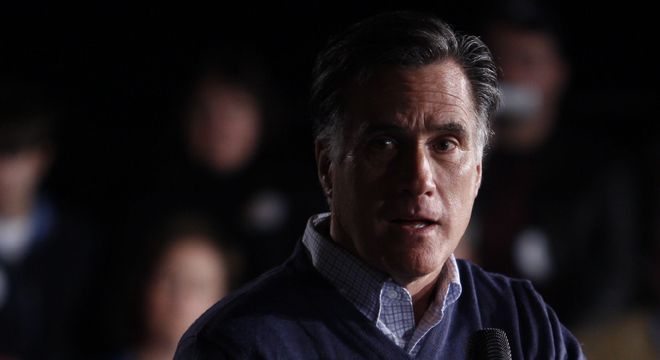

Top Democrats are pushing tax writers in both the House and Senate to close the tax loopholes that likely allowed Mitt Romney to use a savings vehicle for middle class workers to build a nearly $100 million retirement fortune.

Romney’s financial disclosures have famously revealed that his tax-deferred individual retirement account holds upwards of $100 million, an uncomfortable demonstration of enormous wealth, but moreover a source of key ethical questions.

IRAs were designed to allow workers to nest away modest sums of money each year, tax deferred, to finance a middle class retirement. There’s even a legal limit — now $6,000 — on how much each IRA holder can contribute annually.

Romney’s managed to amass more than 100,000 times that much.

So early last month, Reps. Chris Van Hollen (D-MD), George Miller (D-CA) and Sander Levin (D-MI) wrote to the Treasury and Labor departments to make an example of Romney. They asked federal tax officials to explain whether the tax strategy Romney likely used to mushroom his IRA — circumventing the contribution limit by undervaluing assets — is legal, how much revenue it costs the U.S. treasury each year, and whether it should be forbidden.

In response, Mark Mazur, assistant treasury secretary for tax policy, said the scope of the problem remains unknown, but the government knows it exists and is examining ways to curb the practice.

“[T]he IRS has pursued these issues diligently and last year convened a working group to study ways of improving compliance and enforcement in this area,” Mazur wrote. “The group will consider whether any statutory changes would be helpful to this effort.”

Miller and Van Hollen see that as a jumping off point — both to bring Romney’s IRA back into the political spotlight, but also for tax law writers, who will be forced to address this and similar loopholes if and when they overhaul the tax code next year.

“[T]he Internal Revenue Service is currently studying ways to prevent abuse of tax-preferred individual retirement accounts (IRAS) for tax evasion purposes,” the Democrats wrote to the chairs and ranking members of the House Ways and Means Committee and the Senate Finance Committee. “We encourage you to consider this particular area of law as Congress considers tax reform legislation or other legislation that would address the fiscal cliff in a balanced way.”