The entire Senate Democratic caucus — including independents Joe Lieberman (CT) and Bernie Sanders (VT) — have a succinct message for House Speaker John Boehner: cram it!

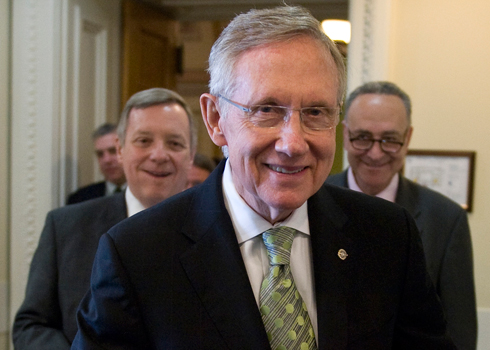

In a Wednesday letter, the Democrats seek to prove what Majority Leader Harry Reid (D-NV) has been saying for days: nobody in his party will vote for Boehner’s debt limit plan, and he should stop claiming it’s a viable solution to the looming default crisis.

“With five days until our nation faces an unprecedented financial crisis, we need to work together to ensure that our nation does not default on our obligations for the first time in our history,” the Dems write. “We heard that in your caucus you said the Senate will support your bill. We are writing to tell you that we will not support it, and give you the reasons why. A short-term extension like the one in your bill would put America at risk, along with every family and business in it. Your approach would force us once again to face the threat of default in five or six short months.”

More than just a warning that the Boehner bill is DOA in the Senate, the letter suggests Dems fear he may be trying to jam them, betting they don’t have the resolve to vote it down at the 11th hour.

It comes moments after a revised Congressional Budget Office analysis late today shows that the Reid and Boehner plans are actually growing more similar — the only point of argument at this point is over how much to raise the debt limit. Republicans accuse Democrats of wanting to extend it through 2012 only to protect President Obama during election season. That’s never been the entire truth — the much bigger concern is that it’ll be much harder for the parties to find common ground on another conditions-based debt limit increase in the middle of 2012.

Democrats have since changed their argument, citing recent reports that the United States’ credit rating will more likely be downgraded if Congress gives President Obama only a few months of additional borrowing authority.

Read the letter in full below.

Speaker John Boehner

U.S. Capitol, H-232

Washington, DC 20515Dear Speaker Boehner,

With five days until our nation faces an unprecedented financial crisis, we need to work together to ensure that our nation does not default on our obligations for the first time in our history. We heard that in your caucus you said the Senate will support your bill. We are writing to tell you that we will not support it, and give you the reasons why.

A short-term extension like the one in your bill would put America at risk, along with every family and business in it. Your approach would force us once again to face the threat of default in five or six short months. Every day, another expert warns us that your short-term approach could be nearly as disastrous as a default and would lead to a downgrade in our credit rating. If our credit is downgraded, it would cost us billions of dollars more in interest payments on our existing debt and drive up our deficit. Even more worrisome, a downgrade would spike interest rates, making everything from mortgages, car loans and credit cards more expensive for families and businesses nationwide.

In addition to risking a downgrade and catastrophic default, we are concerned that in five or six months, the House will once again hold the economy captive and refuse to avoid another default unless we accept unbalanced, deep cuts to programs like Medicare and Social Security, without asking anything of the wealthiest Americans.

We now have only five days left to act. The entire world is watching Congress. We need to do the right thing to solve this problem. We must work together to avoid a default the responsible way – not in a way that will do America more harm than good.

Sincerely,