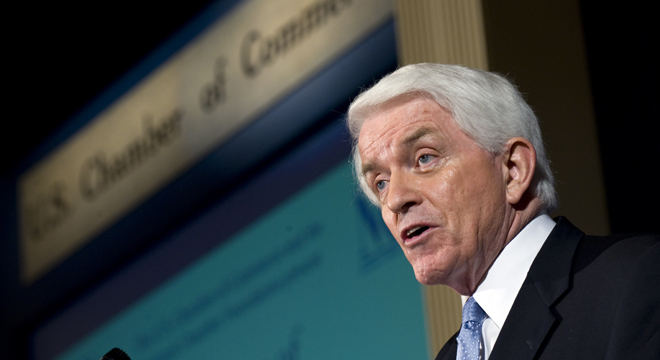

Chamber of Commerce CEO Tom Donohue says further regulation is the wrong response to news that banking giant JP Morgan lost billions of dollars speculating with depositor money. And though he allowed that the development raises legitimate questions about the size of major banks, Donohue defended JP Morgan CEO Jamie Dimon from the criticism he’s received since he announced the staggering losses 10 days ago.

“Nobody’s clear about the Volcker Rule,” Donohue told reporters at a Monday breakfast roundtable hosted by the Christian Science Monitor. “It’s 270 some pages and if you gave it to six experts on the subject, they’d come back with seven interpretations what it means [but] I do also understand why the regulators start looking at the size of some of these places that they really worry.”

Echoing GOP presidential hopeful Mitt Romney, Donohue claimed that the JP Morgan trading losses shouldn’t be viewed in isolation because they resulted in gains for investors on the other side of the trade. But pressed on the point that JP Morgan and other big banks benefit from a federal guarantee, and that unsustainable losses will be covered by the government, Donohue offered an unorthodox take on bailouts and the consequences for taxpayers.

“I’m not worried about the government,” Donohue said. “The first government to help the banks was George Washington, and ever since, every time they do it, they make usurious amounts of money. And the government has got tons of money back from everything they did through the TARP funds and now they were sort of a little chagrinned to say they’re making a lot of money on the AIG deal.”

The Treasury Department has recouped much of the money it spent bailing out banks in 2008 and 2009. But the impact the financial crisis had on the broader economy, in isolation of the direct cost of the bailout legislation, has been staggering.

Donohue argued that the wide calls for new legislation and regulation in the wake of the announcement are unnecessary and potentially harmful — and that JP Morgan will continue to be hugely profitable.

“My own view here, and I think Jamie Dimon — the thing that was most hurt at that bank was his pride, because, you know, he’s a real ‘I’m the guy’ sort of fellow,” Donohue said. Unless efforts to reform Wall Street are rolled back, he added, “[y]ou could have one of these deals where the banks take all of the money they have and put it in the vault and not want to lend it. I’m hyperbolizing for the point that we have so many new regulations.”