Several centrist Democratic Senators have spent the last week wringing their hands a bit over President Obama’s deficit reduction plan and its dependence on increasing taxes on the wealthy and closing corporate loopholes.

Some approve of shutting down the corporate subsidies, while others support hiking taxes for the rich, but none reached by TPM embraced the entire package.

Sen. Mary Landrieu (D-LA), whose state is dependent on the oil-production industry, had previously said she could not support any tax increases targeting the oil and gas industry — but told TPM Wednesday she would back more comprehensive corporate tax reform that involved numerous business sectors.

Landrieu was far more supportive when asked how she feels about the so-called Buffett rule, a loose principle that aims to close the gap between the tax rate paid by some wealthy Americans who benefit from myriad loopholes and deductions and the higher rate paid by many middle-class Americans.

“I’m saying I do support the President’s call to increase revenues as a way of paying down the debt — cutting spending and raising revenues,” she said, noting that she supports higher taxes for those citizens making more than between $500,000 and $1 million.

“Some place in between those amounts — I’m willing to compromise,” she said.

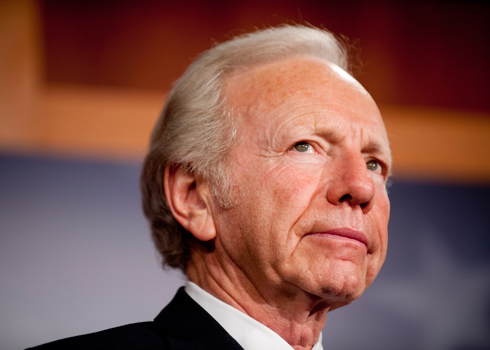

But Sen. Joe Lieberman, an independent from Connecticut who caucuses with the Democrats, said such talk of raising taxes for the rich, while ideal, is pie-in-the-sky, a proposal that isn’t going anywhere in Congress.

Lieberman said he’s disappointed the President’s plan did not include entitlement reform to programs such as Medicare, the root of most of the country’s deficit woes.

“Overall, I don’t think the President’s plan is going to go far,” he told TPM. “At some point we are going to have to look at raising taxes on upper-income people, but I don’t want it to be soon, when we’re still trying to climb out of an economic mess.”

“Should wealthy people pay more taxes? In the best of all worlds…yes,” he conceded. “But Medicare is the largest growth factor in the deficit and I wish he had tackled that.”

Although he changed his affiliation to independent a number of years ago, Lieberman is generally more traditionally liberal when it comes to domestic issues. And his comments are certainly more conciliatory to the White House than Sen. Ben Nelson (D-NE) who has summarily dismissed any talk of raising taxes and wants the deficit super committee to focus solely on cuts.

Other senators avoided the question entirely. Sen. Bill Nelson (D-FL), who is up for re-election next year, told TPM to call his office for his position on the President’s tax reforms.

Update: Nelson’s spokesman Dan McLaughlin said his boss wanted me to call the office so he could set up a later time to talk because he was pressed for time and running for the Capitol subway.

According to McLaughlin, Nelson believes “it’s good the president put forward ideas that are neither totally Republican nor totally Democratic,” but he does not support Obama’s plan to tax the rich.

“[Nelson has supported] or has even voted for some of the provisions, like payroll tax deductions and restoring previous tax rates on those making over $1 million a year,” McLaughlin said. “On the other hand, [he doesn’t] like the idea of higher taxes on people making over $200,000 a year. This plan might have a better chance of passing, if it was broken into smaller parts.”