A giant austerity bomb is timed to go off at the beginning of next year, and the threat of significantly higher taxes and lower spending has Republicans running around the Capitol sounding more like John Maynard Keynes than John Boehner.

Automatic, across-the-board reductions to domestic and defense spending, combined with the looming expiration of the Bush tax cuts, will dramatically consolidate the budget in the next calendar year, if Congress does nothing. And despite bemoaning deficits throughout the Obama years, the GOP’s suddenly come around to the view that cutting government spending is a job killer.

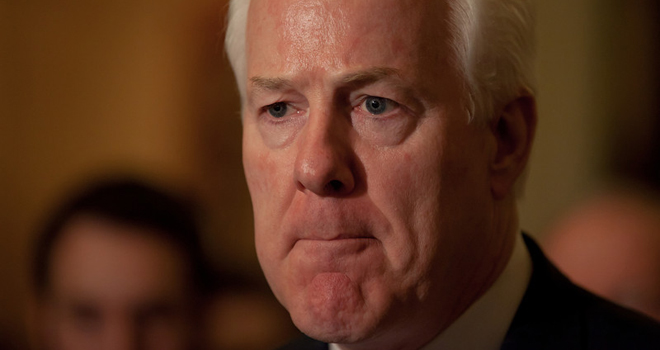

Just listen to Sen. John Cornyn (R-TX).

“Just when you thought the economic news could not get much worse with slow economic growth, with reduced wages because of higher costs, and with many people simply giving up looking for work with the lowest labor participation rate we’ve had in some time,” Cornyn warned reporters in the Capitol Tuesday, “we have an entirely predictable and preventable jobs crisis approaching in January, where because of the sequestration [automatic spending cuts], my state alone will lose 91,000 private sector jobs — and there are about a million private sector jobs at risk if the sequestration goes into effect on January 2.

This marks the return of the Defense Keynesians — Republicans who admit that government spending supports job growth in a weak economy, if and only if that spending is directed toward the military.

As luck would have it, a new Congressional Budget Office concludes Republicans are right about the economic consequences of defense cuts — but that their other fiscal priorities are just as perilous for economic growth.

If all the fiscal tightening scheduled for the beginning of the year is allowed to take effect, it will take a huge bite out of the projected deficit for the coming fiscal year. Unfortunately, it’ll take a similarly large bite out of GDP — enough to threaten a new recession. And the resulting job losses would reduce tax revenues and increase spending on jobless benefits enough to undo billions of dollars in direct deficit reduction.

Per CBO: “Taken together, CBO estimates, those policies will reduce the federal budget deficit by $607 billion, or 4.0 percent of gross domestic product (GDP), between fiscal years 2012 and 2013. The resulting weakening of the economy will lower taxable incomes and raise unemployment, generating a reduction in tax revenues and an increase in spending on such items as unemployment insurance. With that economic feedback incorporated, the deficit will drop by $560 billion between fiscal years 2012 and 2013, CBO projects.”

Conversely, if all of current policy — the Bush tax cuts, the payroll tax holiday, federal spending, etc — is extended, economic growth will boom next year. If Congress picks a middle ground approach — extending the Bush tax cuts but nixing the automatic spending cuts — CBO forecasts modest growth, but no major economic hit.

They obliquely conclude that the wisest economic path for Congress to take would be to defer most or all of the scheduled fiscal restraint, while simultaneously enacting deficit reducing legislation that won’t take effect until the economy’s on sounder footing.

“What would happen if lawmakers changed fiscal policy in late 2012 to remove or offset all of the policies that are scheduled to reduce the federal budget deficit by 5.1 per- cent of GDP between calendar years 2012 and 2013?” CBO asks. “In that case, CBO estimates, the growth of real GDP in calendar year 2013 would lie in a broad range around 4.4 percent, well above the 0.5 percent projected for 2013 under current law. However, eliminating or reducing the fiscal restraint scheduled to occur next year without imposing comparable restraint in future years would reduce output and income in the longer run relative to what would occur if the scheduled fiscal restraint remained in place.”