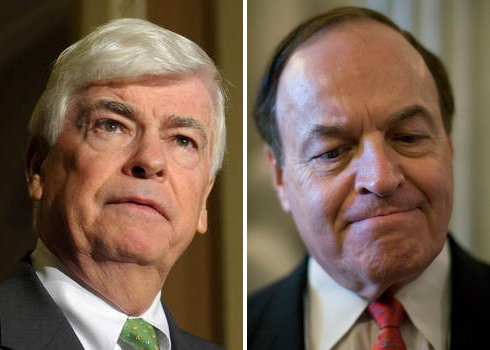

Sen. Richard Shelby (R-AL), the GOP’s top negotiator on financial regulation, has approached his counterpart, Senate Banking Committee Chairman Chris Dodd, with a compromise proposal on one of the most contentious issues in the debate over imposing new rules on Wall Street: the consumer financial protection bureau.

Shelby’s offer is said to be very similar to the independent entity Dodd proposed in the initial draft of his regulatory reform legislation, and, on the merits, of great interest to Dodd himself, who has been seeking GOP support for a comprehensive overhaul for several months.

However, it’s not clear whether the development, which was first reported by The New Republic, represents a breakthrough in negotiations, which have broken down several times in the past. Whether this offer proves to be a panacea will depend entirely on what concessions Shelby seeks on other key elements of the reform proposal. Republicans could find themselves in a precarious political position if they oppose regulatory reform broadly, and some Democrats worry that Shelby’s offer could provide him cover to blame Dodd and the White House for a future breakdown if Democrats balk at Shelby’s other demands.

So what other objections is Shelby raising to Dodd’s bill?

On March 25, Shelby sent a letter to Treasury Secretary Timothy Geithner outlining four key objections. Summarized, they are:

- He says that the bill gives the Fed emergency lending power that’s too broad, authorizing it to make loans against potentially bad collateral.

- He doesn’t like a provision giving the FDIC and the Treasury Department power to issue debt guarantees during a crisis.

- He says there aren’t enough restrictions on what a $50 billion wind-down fund, raised by assessing a fee on big banks, can be used to pay for–though Democrats insist the funds can only be used to close and liquidate the assets of failing firms.

- He argues that giving Fed oversight of large bank holding companies and non-bank financial institutions will, in and of itself, signal to the market that they’re too big to fail, creating a big moral hazard.

Doug Elliott, a Brookings Institution fellow, and regulatory reform expert says the second and fourth objections could be tricky to iron out, though that none of these objections ought to sink a grand bargain on reform. But the legislation is sprawling, and will require Democrats and Republicans to reach accord on a whole range of issues, if they’re to arrive at the truly bipartisan compromise that Dodd has sought.

“We are happy to work with Senator Shelby and his staff to address their concerns and clear up any misconceptions about the bill they may have,” says Banking Committee spokeswoman Kirstin Brost.

Stay tuned.